Capital Discipline and Policy Risk Are Reshaping Global Market Growth Patterns

Tariff uncertainty, selective investment, and sector-level divergence define the current expansion cycle

Overall Market Scale and Growth Outlook

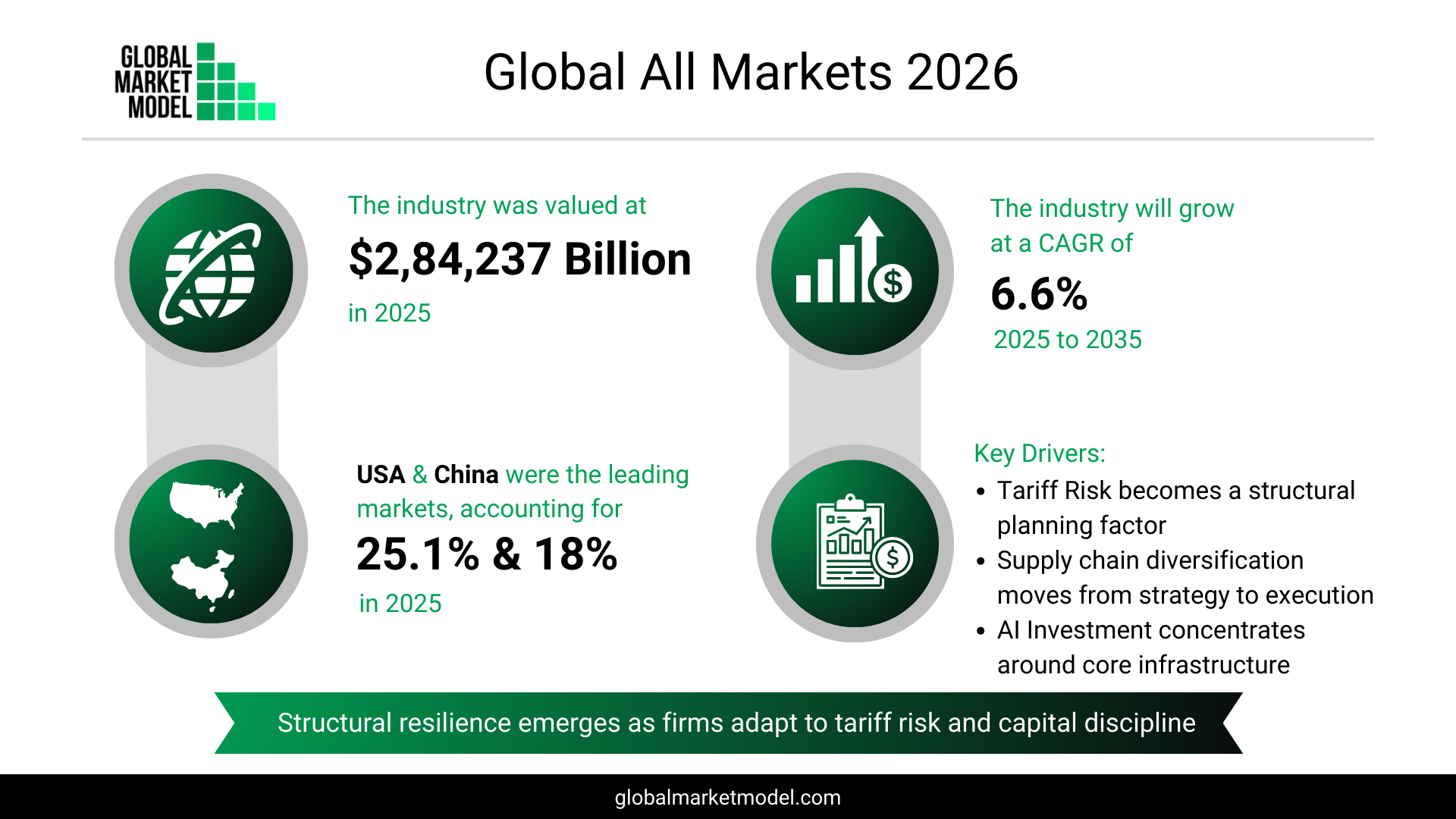

Global Market Model estimates that the total value of all markets reached $284,237 billion in 2025. Looking ahead, the combined markets are expected to grow at a compound annual growth rate (CAGR) of 6.6% between 2025 and 2035, reflecting a balance between resilient demand areas and structurally slower segments.

Fastest- and Slowest-Growing Markets

Growth across markets is increasingly uneven, with clear leaders and laggards emerging based on technology adoption, demographics, and policy alignment.

- Medical equipment is expected to be the fastest-growing market, expanding at a CAGR of 8.9% during 2025–2035

Growth is supported by:

- Advances in robotics, AI, and diagnostic technologies

- Rising preference for minimally invasive treatments

- Aging populations and increasing chronic disease incidence

- Expansion of healthcare infrastructure in emerging economies

- Metals and minerals are projected to be the slowest-growing market, with a CAGR of 4.1% during 2025–2035

Growth constraints include:

- Reduced demand for metals linked to fossil fuel industries

- Policies promoting renewable energy and decarbonization

- Increased recycling rates

- Adoption of lightweight materials across manufacturing industries

Market Concentration by Segment and Geography

In 2025, market value remained concentrated in a small number of large segments and regions.

- The retail and wholesale, financial services, and services markets were the top three segments, accounting for:

- 31.6%, 12.7%, and 6.1% of total market value respectively

- By geography:

- The United States accounted for 25.1% of total global market value

- The China followed with 18.0%, though growth dynamics between the two markets have increasingly diverged

Structural Trends Shaping Recent Market Behavior

Over the past few months, several cross-market themes have become more pronounced, influencing both near-term performance and long-term planning.

Tariff Risk Becomes a Structural Planning Factor

Tariff uncertainty linked to trade policy signals under Donald Trump has shifted from a short-term risk to a structural assumption. Firms are now embedding tariff scenarios into pricing, sourcing, and capital allocation, particularly in:

- Electronics

- Transport equipment

- Machinery

- Industrial inputs

Supply Chain Diversification Moves from Strategy to Execution

During the second half of 2025, diversification efforts progressed from planning to action:

- While China remains central to global manufacturing

- Incremental capacity expansion accelerated in India, Vietnam, Mexico, and Southeast Asia

- Activity focused on categories with high tariff exposure and geopolitical sensitivity

Capital Expenditure Discipline Intensifies

Enterprises adopted a more return-driven and phased approach to investment:

- Large discretionary projects were delayed across:

- Commercial construction

- Enterprise IT programs

- Advanced healthcare infrastructure

- Capital increasingly flowed to modular, scalable initiatives with clearer payback visibility

AI Investment Narrows to Core Infrastructure

AI-related spending remained resilient but more concentrated:

- Investment focused on:

- Data centers

- Cloud infrastructure

- Server GPUs

- Foundational model training

- Adoption of downstream AI applications advanced more cautiously as firms prioritized monetization clarity over experimentation

Regional Growth Divergence Becomes Clearer

Growth trajectories continued to separate:

- The United States remained comparatively resilient, supported by stable consumer demand and services activity

- China’s recovery remained uneven, with weakness in property and construction weighing on industrial and commodity-linked markets

Energy Transition Spending Shows Relative Stability

Despite broader investment caution, spending on:

- Renewable energy

- Grid modernization

- EV infrastructure

- Energy storage

- Green chemicals

largely stayed on track, supported by strong policy commitments and long project timelines.

Inventory Normalization Replaces Destocking

After extended destocking cycles, many sectors entered a phase of inventory normalization:

- This supported steadier demand across manufacturing, retail, and logistics

- However, it did not translate into rapid demand acceleration

What This Signals for the Outlook

Taken together, these developments point to a market environment defined less by broad-based expansion and more by selective resilience. Growth is increasingly concentrated in sectors aligned with technology, healthcare, and energy transition priorities, while capital discipline, tariff risk, and regional divergence continue to shape how and where markets expand over the next decade.

Want to know more about industry outlooks? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

Global Security Pressures and Technology Shifts Redefine Aerospace and Defense Industry Growth

Modern warfare needs, space ambitions, and resilient long-term demand underpin a decade of market expansion

Market Outlook and Growth Projections

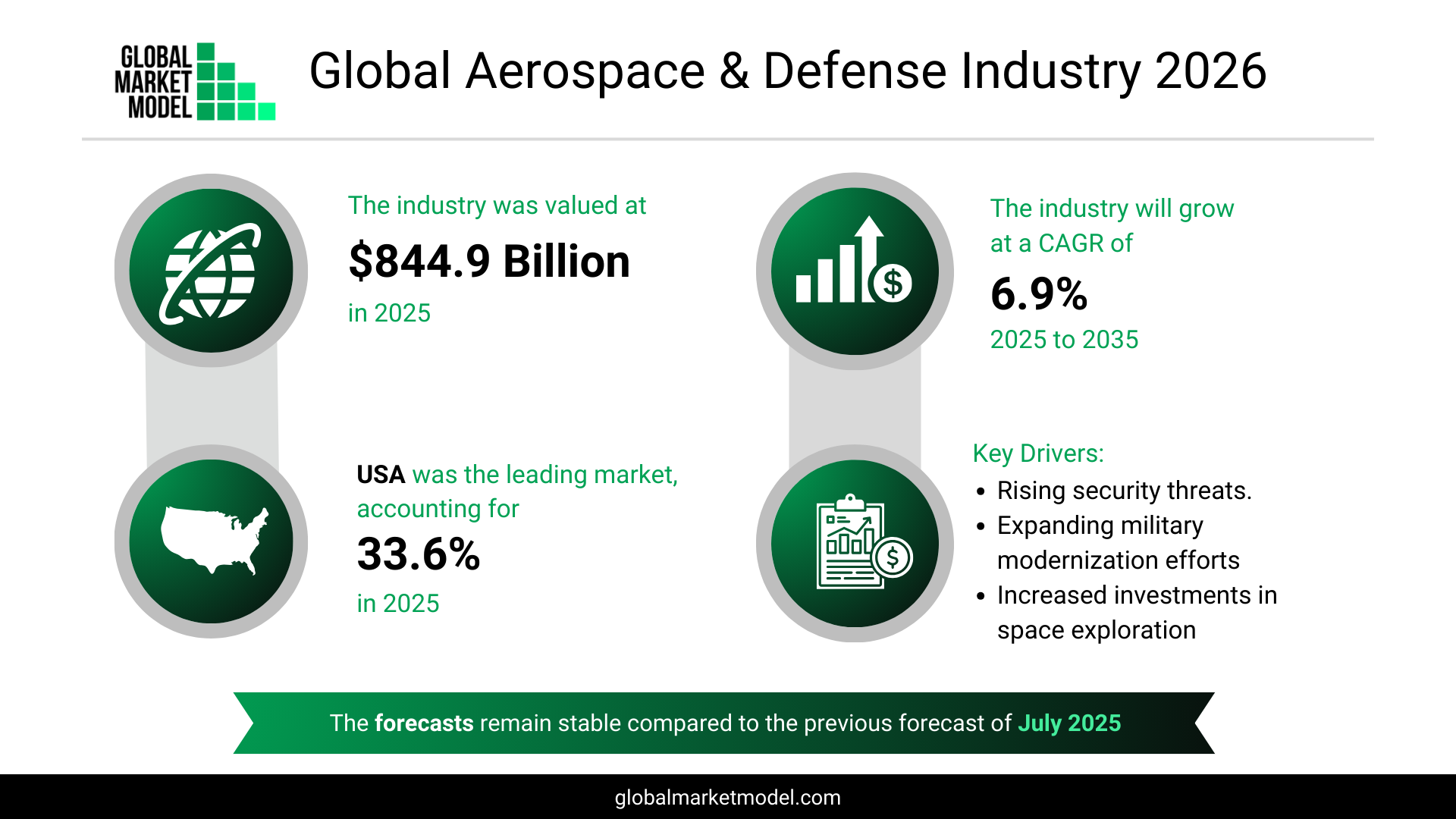

According to Global Market Model’s latest aerospace and defense forecast, the global market is valued at $844.9 billion in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2035. This expansion reflects sustained demand across both defense and civil aerospace applications.

Growth is being driven by:

- Rising global and regional security threats

- Expanding military modernization programs

- Increased investments in space exploration and satellite infrastructure

- Greater deployment of autonomous systems and drones

- Advancements in connected, network-centric defense platforms

- Growth in global air passenger traffic

Scope of the Aerospace and Defense Market

The aerospace segment includes the design and manufacture of aircraft, rockets, missiles, and spacecraft operating across air and space domains. Defense encompasses weapons, arms, and equipment used for military and national security purposes.

In 2025, the aerospace and defense market accounted for 0.7% of global GDP, highlighting its strategic importance to national economies and security agendas.

Defense Spending and Technology Adoption Drive Market Leadership

The defense segment remains the dominant contributor, accounting for 59.7% of the total aerospace and defense market in 2025. Its strength is underpinned by consistently high military expenditure and accelerated adoption of advanced technologies, including:

- Autonomous and unmanned defense systems

- Network-centric and connected battlefield platforms

- Cyber and space-based surveillance capabilities

- Next-generation secure communication systems

Persistent territorial disputes, regional conflicts, and geopolitical tensions continue to reinforce demand for defense equipment and services globally.

The United States led the aerospace and defense market in 2025, accounting for 33.6% of global market value, supported by large defense budgets, ongoing modernization initiatives, and technological leadership.

Regulatory Oversight Shapes Civil Aerospace Dynamics

While defense spending remains robust, the civil aerospace segment has experienced increased regulatory scrutiny, particularly around manufacturing quality, safety compliance, and delivery oversight. High-profile incidents involving commercial aircraft have intensified focus on certification processes and production standards, influencing near-term operational timelines for manufacturers.

Forecast Stability and Long-Term Sector Outlook

Overall projections remain largely stable compared to the June 2025 forecast. In the past six months, factors such as supply chain disruptions, component shortages, and tighter regulatory controls have moderated short-term production and delivery expectations.

Despite these challenges, long-term demand remains resilient, supported by:

- Sustained defense and space-sector investments

- Elevated global security concerns

- Technological advances such as combat-ready high-power laser interception systems

- Increased military deployments in regions including the Indo-Pacific

- Defense assistance initiatives led by the United States and allied nations

Together, these dynamics reinforce a positive and structurally strong long-term outlook for the global aerospace and defense sector.

Gain exclusive insights with The Global Market Model, on the key industry metrics of the aerospace and defense industry such as -

- Government expenditure on defense

- Number of enterprises

- Number of employees

Want to know more about the aerospace and defense industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

How Nutrition Shifts and Farm Innovation Are Reshaping the Global Agriculture Economy

Health-driven consumption, sustainability investments, and efficiency gains define the market’s growth trajectory

A Market Expanding on the Back of Dietary Change

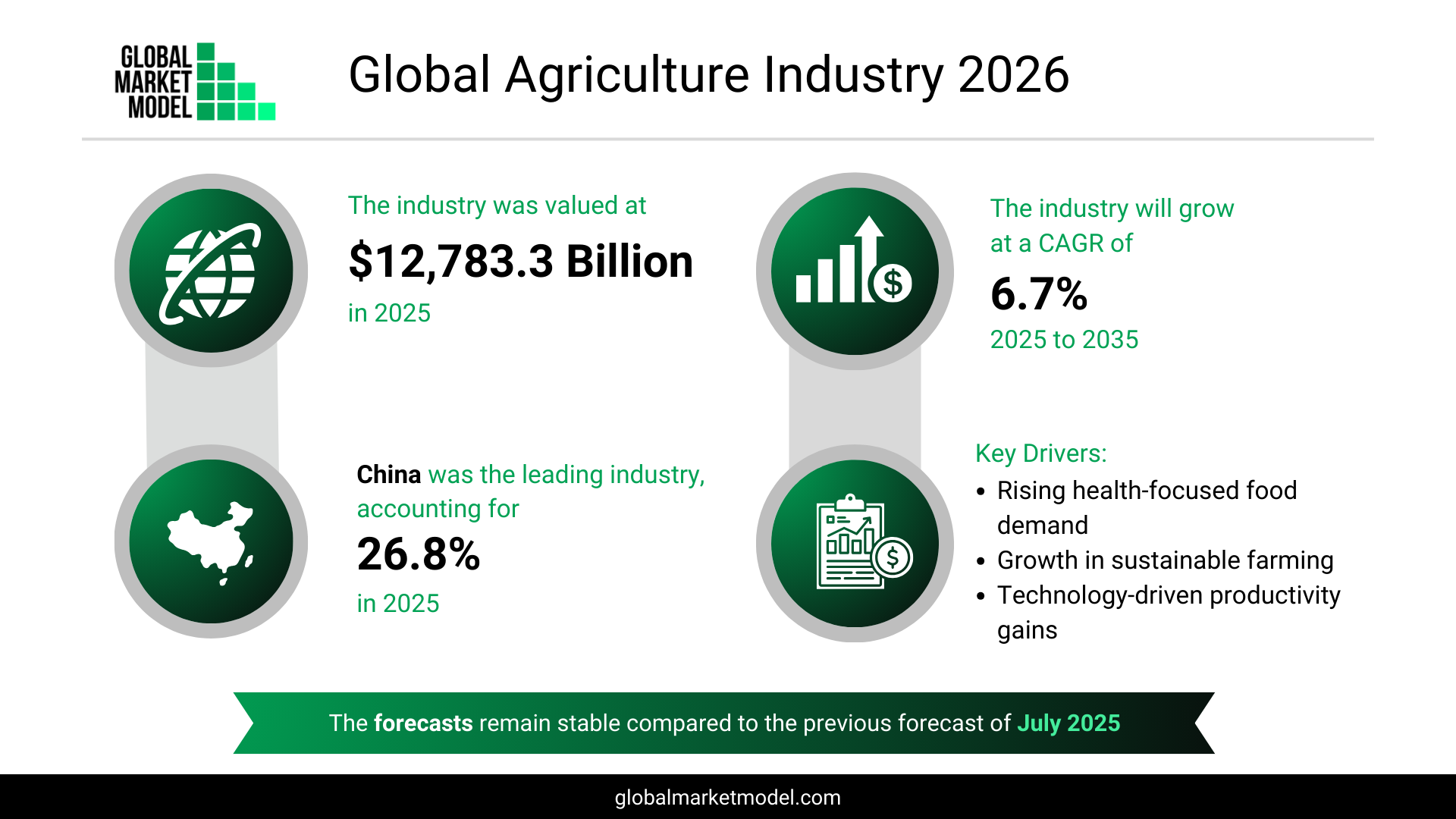

The global agriculture market is valued at $12,783.3 billion in 2025, according to Global Market Model, and is expected to expand at a 6.7% CAGR between 2025 and 2035. Growth is closely linked to changing consumption patterns, particularly rising demand for fruits, vegetables, and whole grains, as awareness of health and nutrition continues to influence food choices worldwide.

Higher willingness to pay for nutrient-dense, high-quality food and increased capital flowing into organic and sustainable farming methods are further strengthening market momentum.

Agriculture’s Scale and Role in the Global Economy

Agriculture spans the cultivation of crops and the rearing of animals and birds for food, fibers, fabrics, biofuels, medicinal inputs, and other essential products that support daily life.

In economic terms, the sector accounted for 10.9% of global GDP in 2025, highlighting its central role across developed and emerging economies. On a consumption basis, global spending translated to $1,584.9 per person per year, reflecting broad-based and consistent demand.

Consumption Strength and Segment Leadership

Demand conditions in the agriculture market remain robust, supported by a combination of lifestyle and income trends. These include:

- Growing focus on health, fitness, and nutrition

- Rising urban incomes and disposable spending

- Strong and sustained consumption of animal protein

- Policy support and incentives aimed at improving farm productivity and food availability

Within the market, crop production continues to anchor overall performance, representing 40.9% of total market value in 2025.

Geographically, the China emerged as the largest agriculture market, accounting for 26.8% of global value, driven by scale, domestic demand, and sustained investment across farming systems.

Navigating Uncertainty While Lifting Farm Productivity

Compared with the July 2025 forecast, outlooks remain largely unchanged, despite near-term pressures. Over the last six months, **trade and policy uncertainty—particularly linked to U.S. tariffs and export controls—**has encouraged more cautious pricing and procurement in some markets.

At the same time, the sector has continued to strengthen its operational base through investments in:

- Precision and data-led agriculture

- Digital tools for farm planning and monitoring

- Sustainable cultivation practices

- Improved irrigation and resource management

These investments are helping offset external volatility by improving yields, efficiency, and resilience.

Consolidated Outlook

Taken together, rising health awareness, sustained food demand, technology-enabled productivity, stabilizing supply chains, and a global push toward food security and sustainability are expected to support steady, long-term growth in the global agriculture market.

Gain exclusive insights with The Global Market Model on key industry metrics in the agriculture sector, including:

- Arable land

- Livestock population

- Poultry population

- Area cultivated for grains

- Area cultivated for oil seeds

- Area cultivated for vegetables

- Area cultivated for fruits

- Number of enterprises

- Number of employees

Want to explore the agriculture market outlook further? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

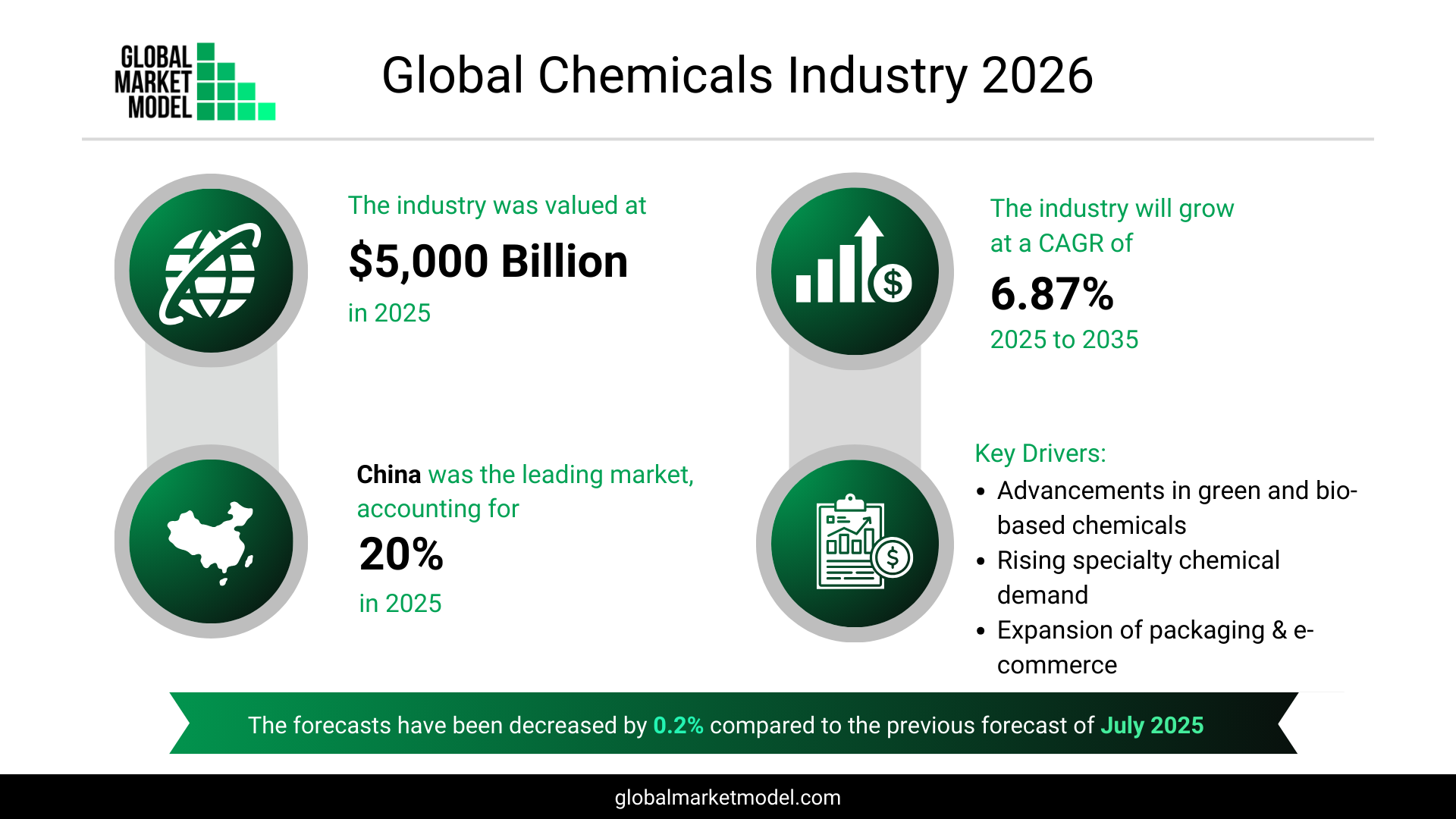

Why the Chemicals Industry Is Shifting from Volume-Led Growth to Value-Led Expansion

End-market diversification, sustainability pressures, and specialty chemistry investments are redefining growth expectations

A Market Growing Through Higher-Value Applications

The global chemicals market is estimated at $5,000 billion in 2025, according to Global Market Model, and is forecast to grow at a 6.87% CAGR between 2025 and 2035. Growth is increasingly shaped by application-driven demand rather than broad-based capacity expansion, with momentum coming from sectors such as electronics, healthcare, packaging, and e-commerce-linked manufacturing.

Progress in green and bio-based chemicals and rising capital allocation toward specialty chemical segments are further reinforcing this shift toward value creation.

What Defines the Chemicals Industry

Chemical compounds are produced through the conversion of organic and inorganic raw materials using chemical reactions, processing, and formulation. These materials form the backbone of multiple industrial value chains, supplying essential inputs to agriculture, construction, consumer goods, pharmaceuticals, and advanced manufacturing.

In 2025, the chemicals sector accounted for 4.3% of global GDP, underscoring its role as a foundational industry rather than a standalone end market.

Demand Fundamentals and Segment Concentration

Structural demand for chemicals remains supported by:

- Broad reliance on chemicals across industrial and consumer-facing sectors

- Rapid urbanization and infrastructure development

- The scale of the global agriculture industry across developed and emerging economies

- Tighter environmental and pollution-control regulations, increasing demand for compliant formulations

- A large global consumer base supported by well-developed industrial ecosystems

Within the market, ethyl alcohol and other basic organic chemicals represented the largest segment, accounting for 28.6% of total market value in 2025.

On a geographic basis, the China remained the largest market, contributing 20.0% of global chemicals demand in 2025, supported by scale, integration across value chains, and strong downstream manufacturing activity.

Short-Term Headwinds Reshape Near-Term Planning

Compared with the July 2025 forecast, growth expectations for 2025–2035 have been revised downward by 0.2%, reflecting a more cautious short-term environment. Over the last six months, chemical producers have contended with:

- Overcapacity in base chemicals and polymer segments

- Heightened trade tensions and tariff uncertainty, affecting export competitiveness

- Margin pressure from volatile energy and feedstock costs

These dynamics have prompted production adjustments, delayed capacity additions, and more conservative investment planning across major chemical hubs.

Where the Industry Is Finding Its Next Growth Levers

Even as near-term conditions remain uneven, the long-term direction of the chemicals market is being shaped by expanding end-use applications, regional supply chain diversification, and strategic investment in sustainable and advanced chemical technologies. The transition toward specialty and bio-based chemistry is progressing more gradually than earlier forecasts assumed, but it continues to provide a durable foundation for growth as industrial demand, regulatory requirements, and innovation priorities converge.

Gain exclusive insights with The Global Market Model on key metrics in the chemicals industry, including:

- Number of enterprises

- Number of employees

Want to know more about the chemicals industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

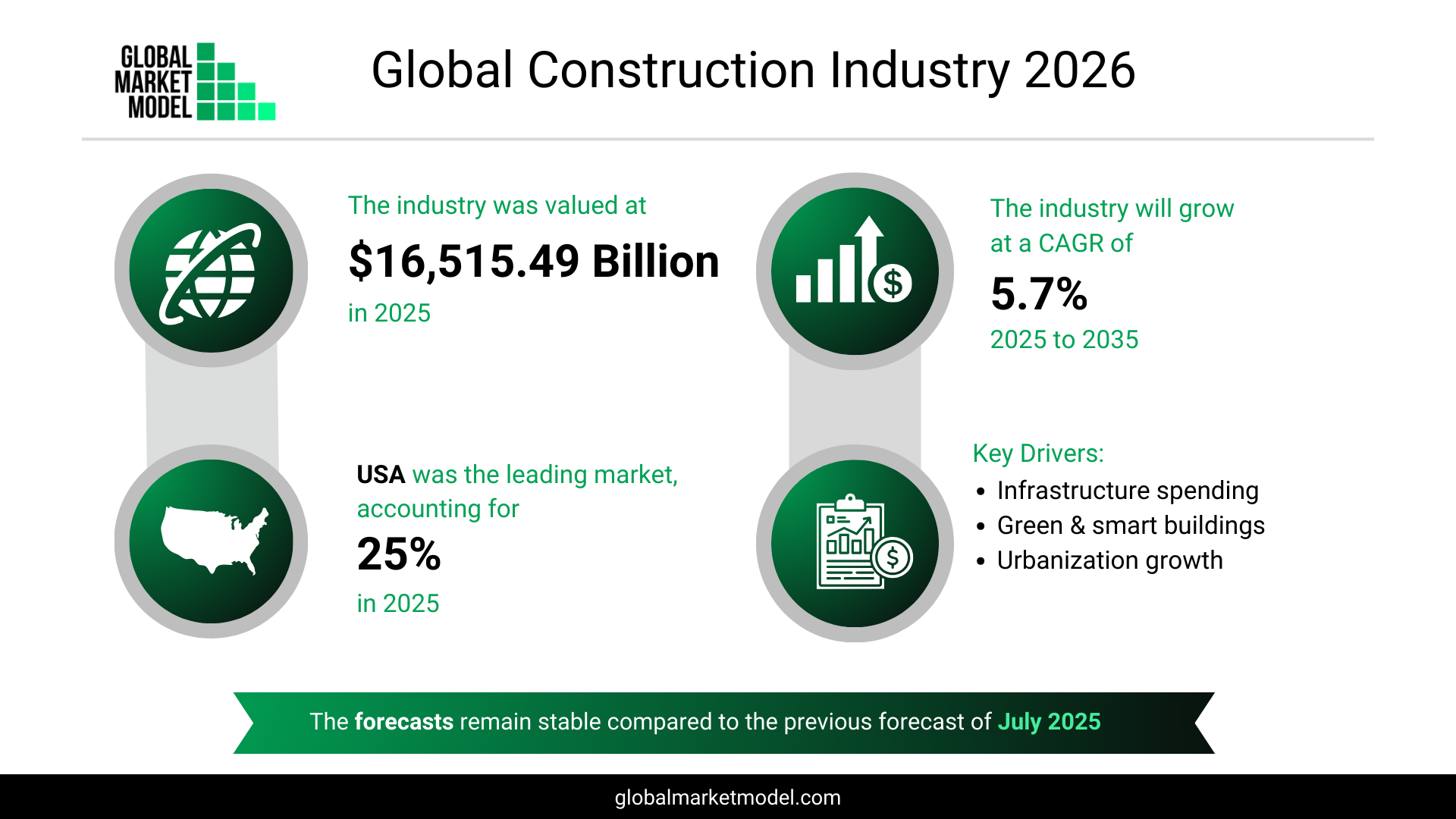

How Green Infrastructure, Urban Expansion, and Digital Builds Are Redefining the Construction Economy

Public spending, sustainability mandates, and smart city programs anchor long-term growth despite near-term pressures

A Trillion-Dollar Market with Steady Expansion Ahead

Global Market Model estimates the global construction market at $16,515.49 billion in 2025, with growth expected at a 5.7% CAGR from 2025 to 2035. Market expansion is being shaped by sustained government-led infrastructure spending, accelerating industrialization, and a structural shift toward environmentally responsible construction practices.

Key forces supporting growth include:

- Rising public expenditure on infrastructure development

- Widespread adoption of green construction initiatives

- Increasing emphasis on energy-efficient buildings

- Expansion of smart city projects across developed and emerging economies

What Construction Encompasses and Why It Matters Economically

Construction covers the building, modification, repair, and demolition of structures, executed through defined designs, engineering standards, and project plans. The sector plays a central role in enabling housing, transportation, utilities, and industrial activity.

In 2025:

- Construction accounted for 14.1% of global GDP, highlighting its macroeconomic significance

- Per capita construction spending reached $2,047.574 per year, reflecting sustained global investment in built environments

Demand Foundations and Segment Leadership

The construction market continues to be underpinned by long-term demand fundamentals, including:

- A large and growing consumer base in both developed and developing regions

- High spending on residential housing and commercial real estate

- Continued investment in transport, utilities, and industrial infrastructure

- Development of economic corridors aimed at attracting foreign direct investment in emerging markets

From a structural perspective, buildings construction emerged as the largest segment, accounting for 46.0% of total market value in 2025, driven by residential, commercial, and institutional projects.

Geographically, the United States led the global construction market, contributing 25% of total value in 2025, supported by infrastructure renewal programs, commercial development, and housing demand.

Short-Term Constraints Affecting Project Momentum

Compared with the July 2025 forecast, overall projections remain largely unchanged, though recent months have introduced notable execution challenges. Over the past six months, construction activity has been influenced by:

- Ongoing financial stress in China’s real estate sector

- Slower housing activity despite declining interest rates

- Labor shortages and rising wage pressures

- Elevated material and equipment costs, affecting margins and timelines

These pressures have been compounded by uneven public infrastructure spending, project approval delays, renewed trade policy uncertainty, and potential tariffs on critical construction inputs, collectively tightening cost and supply chain conditions.

Where Long-Term Momentum Is Being Built

Despite near-term friction, the construction sector continues to attract capital toward future-focused priorities. Investment is increasingly directed at energy transition infrastructure, smart city development, digital construction tools, and climate-resilient building systems. Alongside urban infrastructure upgrades across both mature and high-growth markets, these trends are reinforcing confidence in the sector’s ability to deliver durable, long-term growth even as execution risks persist in the short run.

Gain exclusive insights with The Global Market Model on key metrics in the construction industry, including:

- Number of households

- Construction spending

- Number of new households

- Number of enterprises

- Number of employees

Want to know more about the construction industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

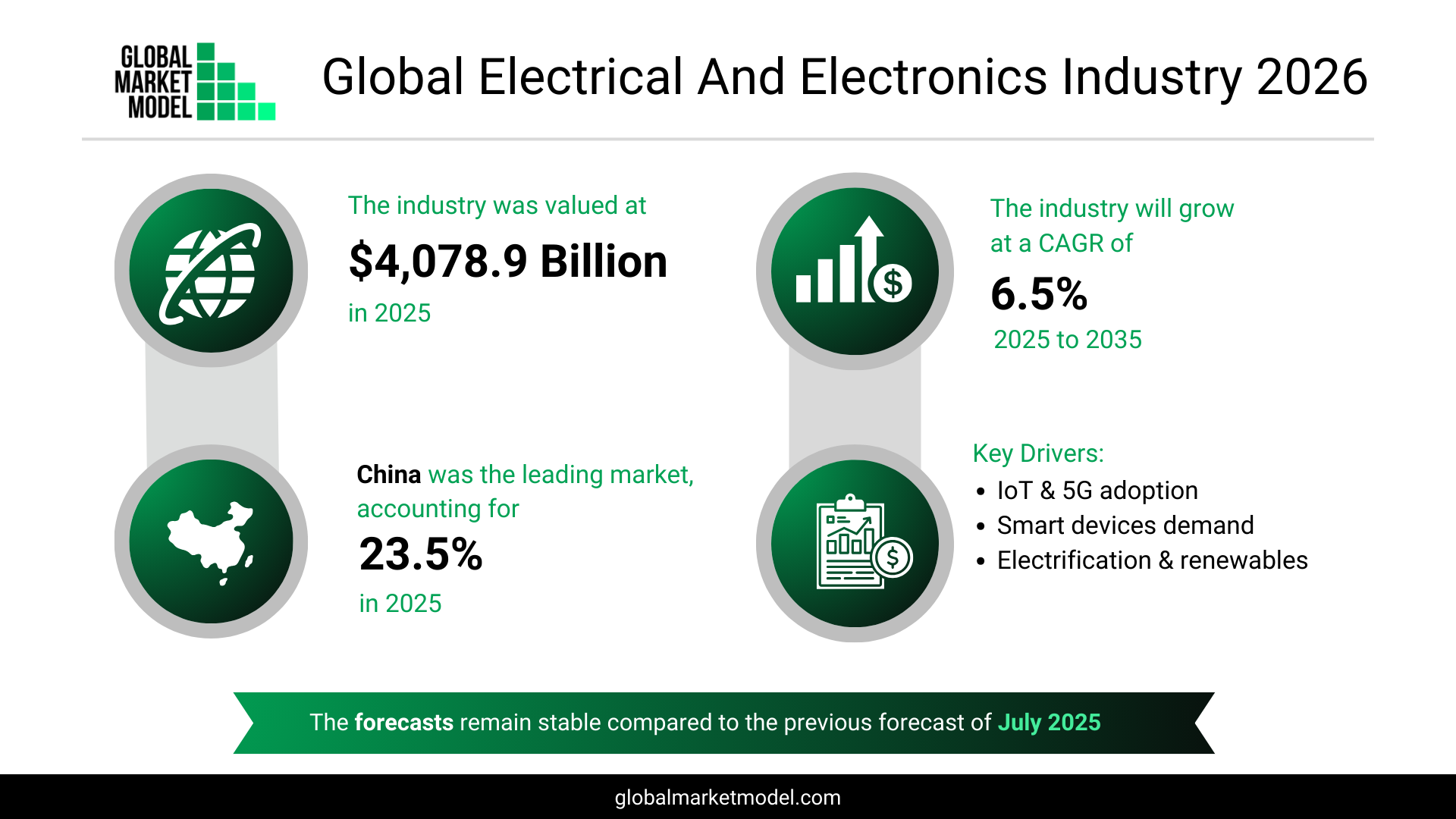

Electrification Momentum and Intelligent Technologies Accelerate the Electrical and Electronics Market

Connected devices, AI integration, and power-system investments underpin a stable long-term growth trajectory

Scale of Expansion in a Digitally Enabled Market

Global Market Model values the global electrical and electronics market at $4,078.9 billion in 2025, with the market expected to expand at a 6.5% CAGR between 2025 and 2035. Growth is being shaped by parallel shifts in digital adoption and electrification, as electronics become more embedded across consumer, industrial, and infrastructure systems.

Key technology-led growth enablers include:

- Widespread deployment of the Internet of Things (IoT)

- Advances in 5G communications, enabling real-time connectivity

- Progress in advanced sensor technologies and virtual reality

- Deeper integration of AI and machine learning in consumer and industrial electronics

- Rising adoption of smart home solutions and connected appliances

- Increased investment in renewable energy and power infrastructure

What Defines the Electrical and Electronics Ecosystem

Electrical products are designed to generate, distribute, and utilize electrical power, while electronic products incorporate circuits capable of processing signals or emitting physical fields of radiation during operation. Together, these products form the backbone of modern digital economies, energy systems, mobility, and industrial automation.

In 2025:

- The sector accounted for 3.5% of global GDP, reflecting its enabling role across industries

- Per capita consumption reached $505.7 per person per annum, indicating broad-based global adoption

Demand Conditions and Market Structure

The electrical and electronics market continues to benefit from structurally strong demand drivers, including:

- A large consumer base across both developed and emerging economies

- High levels of internet penetration and digital usage

- Ongoing demand for technology upgrades and performance improvements

- Expanding adoption of electric vehicles and charging infrastructure

- Growing dependence on reliable power systems in critical infrastructure and industrial operations

From a segmentation perspective, the electrical equipment segment led the market, accounting for 43.1% of total market value in 2025, reflecting sustained investment in grids, electrification components, and industrial power systems.

At the country level, China was the leading market, contributing 23.5% of global market value in 2025, supported by large-scale manufacturing capacity, strong domestic demand, and export-oriented production.

Supply-Side Pressures and Policy-Led Resilience

Outlooks for the 2025–2035 period remain stable compared with the previous update, despite supply-side challenges over the past six months. These have included semiconductor shortages, elevated input costs, and capacity constraints in key Asian manufacturing hubs. Some pressure has eased as logistics bottlenecks have gradually been resolved and availability of intermediate components has improved.

Longer-term resilience is being reinforced through government-led semiconductor and electronics initiatives in the U.S., South Korea, and the EU, including new fabrication capacity and subsidy programs. While trade-related uncertainties—such as U.S. tariffs and tighter export controls—continue to temper near-term planning, sustained demand for AI-driven GPUs, smart devices, electrification components, and renewable-energy-related electronics continues to support confidence in the market’s long-term growth path.

Gain exclusive insights with The Global Market Model on key metrics in the electrical and electronics industry, including:

- Number of enterprises

- Number of employees

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

Want to know more about the electrical and electronics industry outlook? Let us help you!

Request a Demo

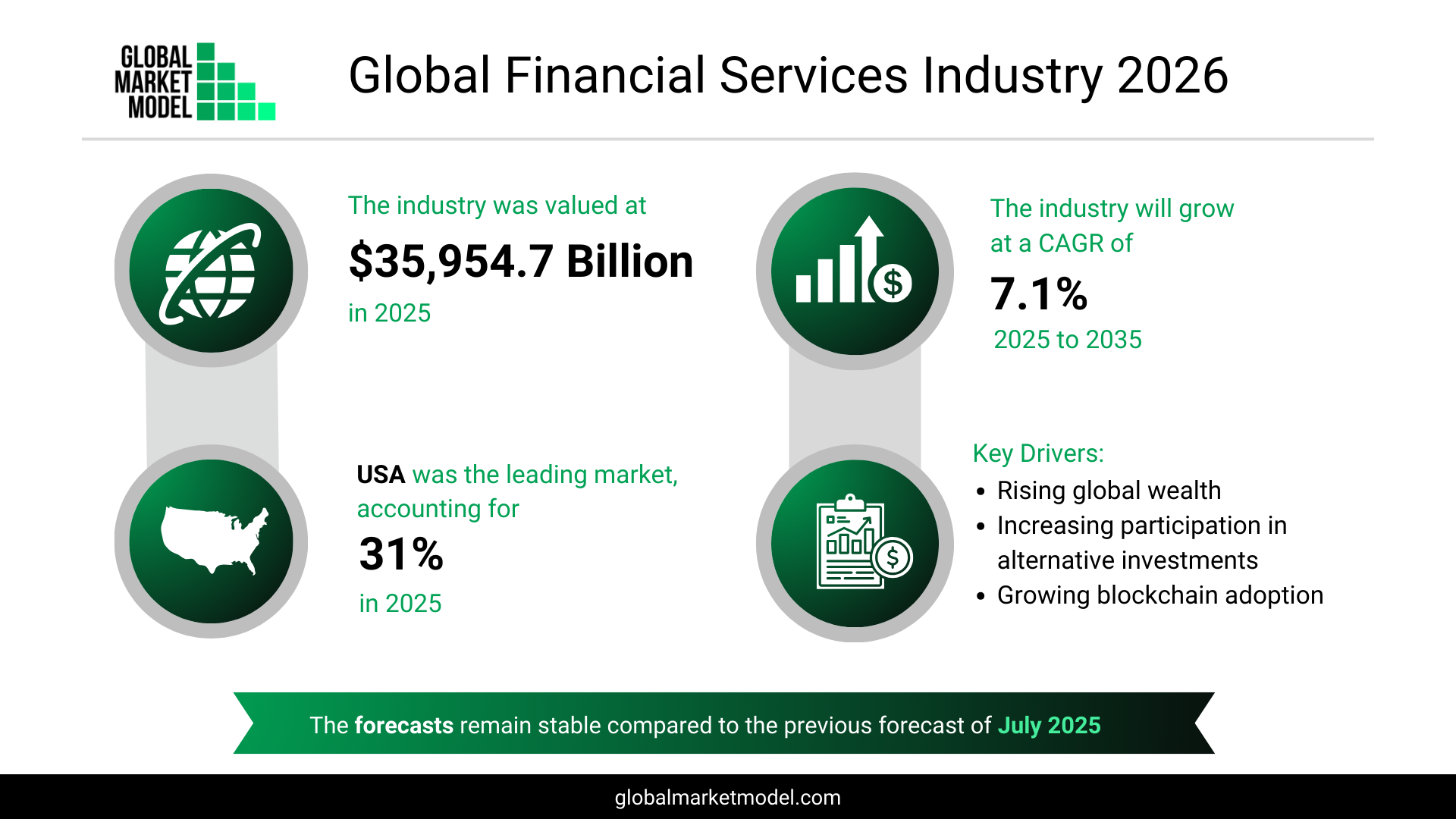

Digital Finance, Alternative Assets, and Payment Innovation Reshape the Financial Services Landscape

Rising wealth, fintech adoption, and secure transaction technologies sustain long-term sector expansion

A Market Expanding on Digital and Investment Momentum

Global Market Model estimates the global financial services market at $35,954.7 billion in 2025, with the sector projected to grow at a 7.1% CAGR between 2025 and 2035. Growth is being supported by rising global wealth levels, increased participation in alternative investment vehicles, and the expanding use of blockchain technologies to enhance transaction security and transparency.

Ongoing digital transformation across banking and financial institutions, alongside growing adoption of artificial intelligence for financial planning and decision-making, continues to reshape service delivery and customer engagement models.

What Constitutes the Financial Services Sector

Financial services encompass a wide range of activities that facilitate financial transactions, risk management, and capital allocation. These include lending, insurance, investment management, credit services, and digital payment and money transfer solutions.

In 2025, the sector accounted for 30.8% of global GDP, underscoring its central role in global economic activity. The market benefits from:

- Widespread internet and smartphone penetration

- Mature infrastructure for digital and real-time payments

- Continued reliance on a mix of traditional banking and digital financial platforms

Segment Dynamics and Sources of Demand

Within the financial services ecosystem, demand remains concentrated across both transactional and risk-management services.

- The lending and payments segment remains the dominant contributor, accounting for 36.6% of total market value in 2025, driven by digital payments, consumer credit, and cross-border transaction needs.

- The insurance segment continues to expand, supported by:

- High healthcare expenditure in developed economies

- Aging populations in Europe and Japan

- A growing middle class in countries such as China and India

At the country level, the United States remained the largest financial services market, accounting for 31% of global market value in 2025, supported by deep capital markets, fintech innovation, and high financial inclusion.

Regulatory Shifts and Market Volatility in the Near Term

Forecasts for the financial services sector remain largely stable compared with the July 2025 outlook, despite evolving operating conditions over the past six months. Financial institutions have been adjusting to:

- Changing regulatory frameworks and monetary policies

- Cautious optimism in lending and investment markets amid expectations of interest rate reductions in major economies

- Heightened regulatory scrutiny of fintech, digital lending, and cryptocurrency-related services, leading to stronger risk management and compliance practices

Geopolitical tensions in the Middle East and Eastern Europe have contributed to foreign exchange volatility, while new U.S. tariffs have increased caution around cross-border transactions, particularly in foreign exchange and correspondent banking.

Stability Anchored in Digital Access and Inclusion

Despite short-term regulatory and geopolitical pressures, the financial services sector continues to be supported by robust digital infrastructure, expanding financial access, and ongoing efforts to modernize payment systems. Continued innovation in digital payments, alternative investments, and inclusive financial platforms is reinforcing confidence in the sector’s ability to maintain stable, long-term growth as global financial systems evolve.

Gain exclusive insights with The Global Market Model on key metrics in the financial services industry, including:

- Number of enterprises

- Number of employees

Want to know more about the financial services industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

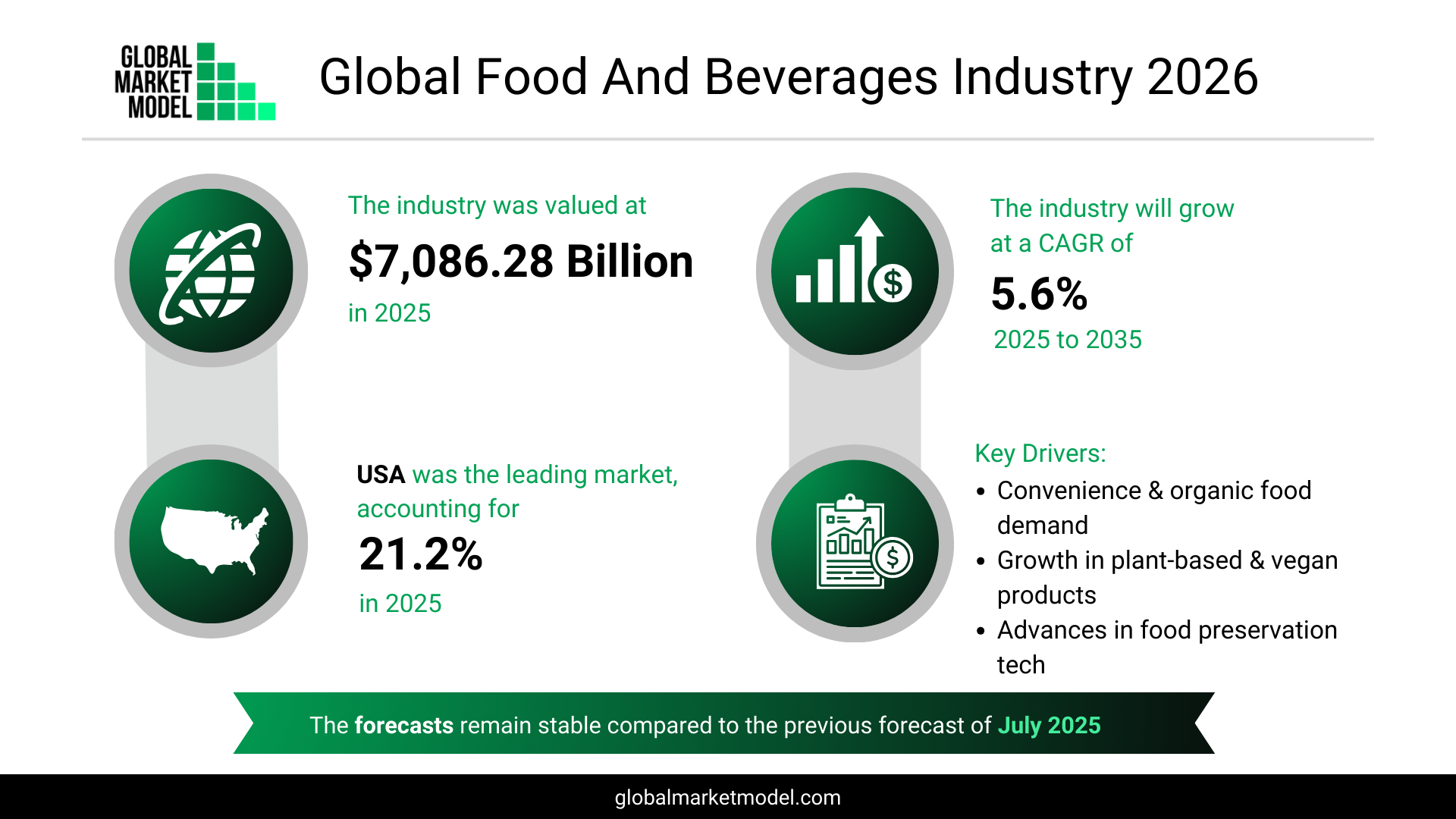

The Global Food and Beverages Market: A $7 Trillion Industry Shaped by Health and Convenience

Changing diets, product innovation, and steady consumption patterns define long-term market evolution

Market Size and Growth Trajectory

Global Market Model estimates the global food and beverages market at $7,086.28 billion in 2025, with the market projected to grow at a 5.6% CAGR during 2025–2035. Growth reflects steady expansion supported by population growth, recurring consumption, and continuous product development across categories.

Consumer preferences are increasingly influencing market direction, particularly demand for convenient formats, health-oriented offerings, and diet-specific food solutions.

Product Scope and Economic Significance

The food and beverages industry includes consumable products that provide nutrition and hydration, covering fresh, frozen, packaged, and processed foods distributed through retail, foodservice, and institutional channels.

In 2025:

- The sector accounted for 6.1% of global GDP, highlighting its importance as a core consumption industry

- Per capita consumption reached $878.5 per person per annum, reflecting broad and consistent global demand

Consumption Behavior and Category Concentration

The market is characterized by a large and diverse consumer base across both developed and developing economies. Demand is supported by:

- High reliance on packaged and ready-to-consume foods, particularly in urban settings

- Rising disposable incomes in major consumption markets

- Shifting dietary habits driven by fitness awareness and nutrition education

- Government-backed initiatives promoting balanced diets and protein intake

Demand for poultry, meat, and seafood products remains structurally strong. In 2025, the meat, poultry, and seafood segment was the largest category, accounting for 23.2% of total market value.

Geographically, the United States led the global food and beverages market, contributing 21.2% of total market value, supported by advanced food processing infrastructure and high consumption levels.

Technology and Product Innovation Across the Value Chain

Innovation continues to play a critical role in shaping competitiveness across the food and beverages industry. Key developments include:

- Increased use of individual quick freezing (IQF) technologies

- Advancements in food preservation and processing methods

- Expansion of organic, plant-based, vegan, and functional food categories tailored to specific dietary needs

These innovations are enabling manufacturers to improve shelf life, scalability, and nutritional positioning.

Operating Conditions and Forward View

Compared with the July 2025 forecast, outlooks remain largely stable, despite short-term challenges such as weather-related crop impacts, input supply disruptions, and emerging trade policy uncertainty, including proposed U.S. tariffs on select imports.

At the same time, continued urbanization, sustained demand for convenient and nutritionally positioned foods, and ongoing investment in processing efficiency and sourcing strategies continue to reinforce the long-term resilience of the global food and beverages market.

Gain exclusive insights with The Global Market Model on key industry metrics of the food and beverages industry such as:

- Number of enterprises

- Number of employees

- Livestock primary meat

Want to explore deeper trends in the food and beverages industry? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

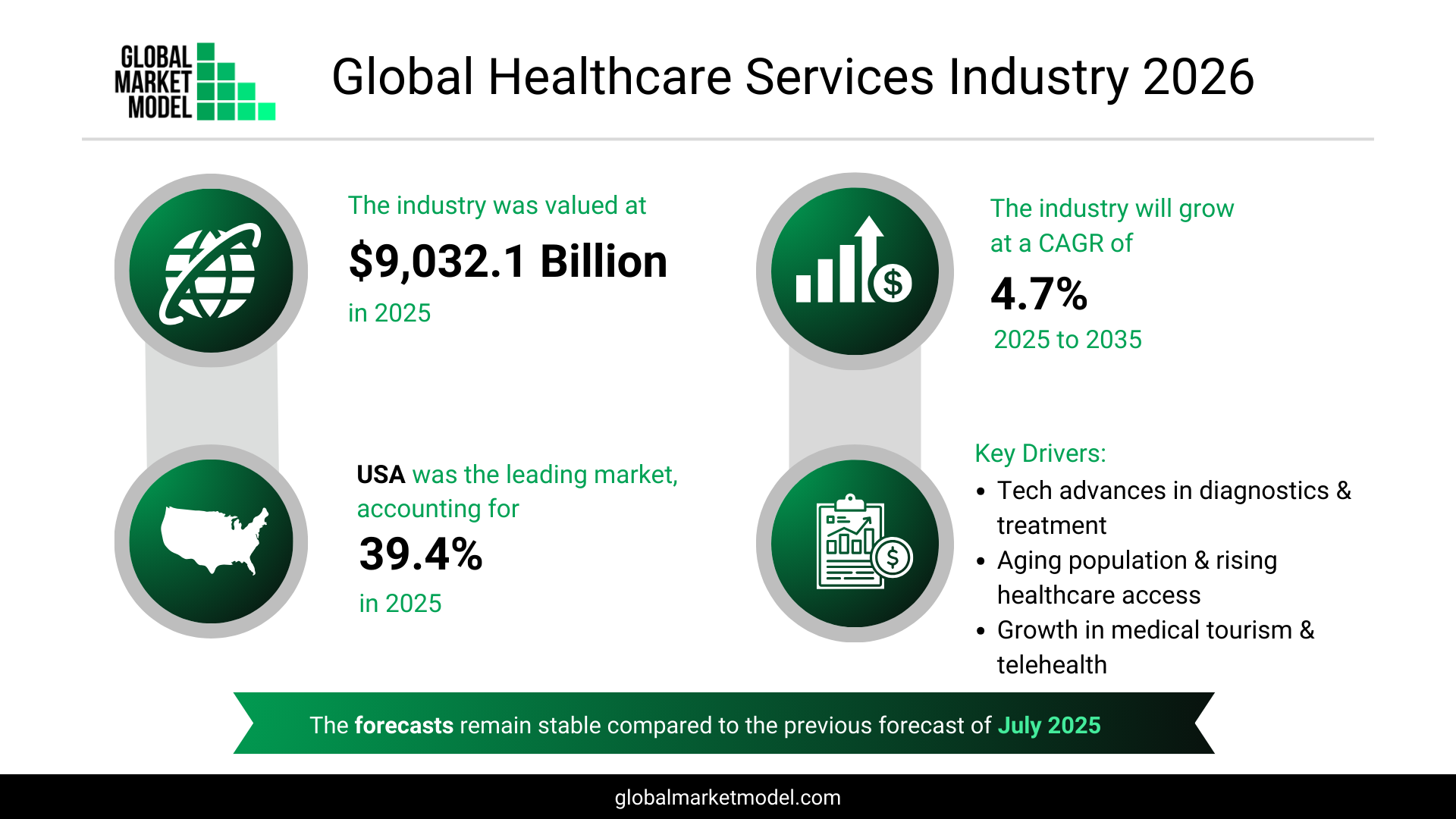

The Global Healthcare Services Market Enters a Technology-Led Expansion Phase

Broader access, medical innovation, and policy reforms reshape how care is delivered worldwide

Market Size and Growth Outlook

Global Market Model estimates the global healthcare services market at $9,032.1 billion in 2025, with the market projected to grow at a 4.7% CAGR from 2025 to 2035. Growth is being driven by a combination of medical technology advancement, widening access to care, and structural changes in how healthcare systems respond to demographic and lifestyle shifts.

Key drivers supporting market expansion include:

- Advancements in diagnostic and therapeutic equipment

- Lifestyle changes and a rise in sedentary occupations

- Improvements in survival rates and quality of life

- Growth in medical tourism

- Expanded access to healthcare services across regions

Scope of Healthcare Services and Economic Significance

Healthcare services encompass the delivery of preventive, diagnostic, therapeutic, and rehabilitative care by trained professionals and healthcare organizations.

In 2025:

- The market accounted for 7.7% of global GDP, highlighting its central role in national economies

- Per capita healthcare services consumption reached $1,119.8 per person per annum, reflecting sustained and essential demand

The sector continues to benefit from technological progress that improves affordability and access, alongside high healthcare expenditure in developed economies and active government participation in system strengthening.

Demand Drivers and Segment Leadership

Structural demand for healthcare services remains strong, supported by:

- Rising per-capita incomes in key markets

- High public and private healthcare spending in developed countries

- Government-led programs aimed at expanding coverage and outcomes

- Increasing prevalence of age-related conditions, including Alzheimer’s and Parkinson’s disease

From a service mix perspective, hospitals and outpatient care centers remained the largest segment in 2025, accounting for 53.4% of total market value, reflecting their central role in both acute and routine care delivery.

Geographically, the United States led the global healthcare services market, representing 39.4% of total demand in 2025, supported by high spending levels, advanced infrastructure, and policy-driven innovation.

Operating Pressures and System-Level Responses

Compared with the July 2025 forecast, overall projections remain largely stable, despite operational challenges over the past six months. Healthcare systems globally have faced:

- Persistent workforce shortages

- Rising labor and operating costs

- Resulting constraints on service availability and longer patient wait times

In response, governments and health systems have taken targeted actions. The United States has introduced Medicare reforms focused on expanding telehealth coverage and accelerating the shift toward value-based care. In parallel, health systems in the United Kingdom and parts of Southeast Asia have increased funding for AI-enabled diagnostics and initiatives designed to improve clinical productivity and care efficiency.

A Care Model in Transition

While temporary disruptions—such as labor disputes—have affected certain regions, underlying demand for healthcare services remains resilient. Aging populations, continued policy investment, and accelerating adoption of digital, remote, and technology-enabled care models are collectively pushing healthcare systems toward more agile and scalable service delivery. These forces are reinforcing the healthcare services market’s steady long-term growth trajectory, even as providers adapt to near-term operational constraints.

Explore healthcare metrics in detail with The Global Market Model, including:

- Asthma prevalence rate

- Cancer prevalence rate

- Cerebrovascular prevalence rate

- Dermatitis prevalence rate

- Healthcare expenditure

- Hearing loss prevalence rate

- HIV prevalence rate

- Diabetes prevalence rate

- Glaucoma prevalence rate

- Healthcare - number of employees

- Healthcare - number of enterprises

- Hospital beds

- Hypertension prevalence rate

- Number of dentists

Want to dive deeper into the global healthcare services market?

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

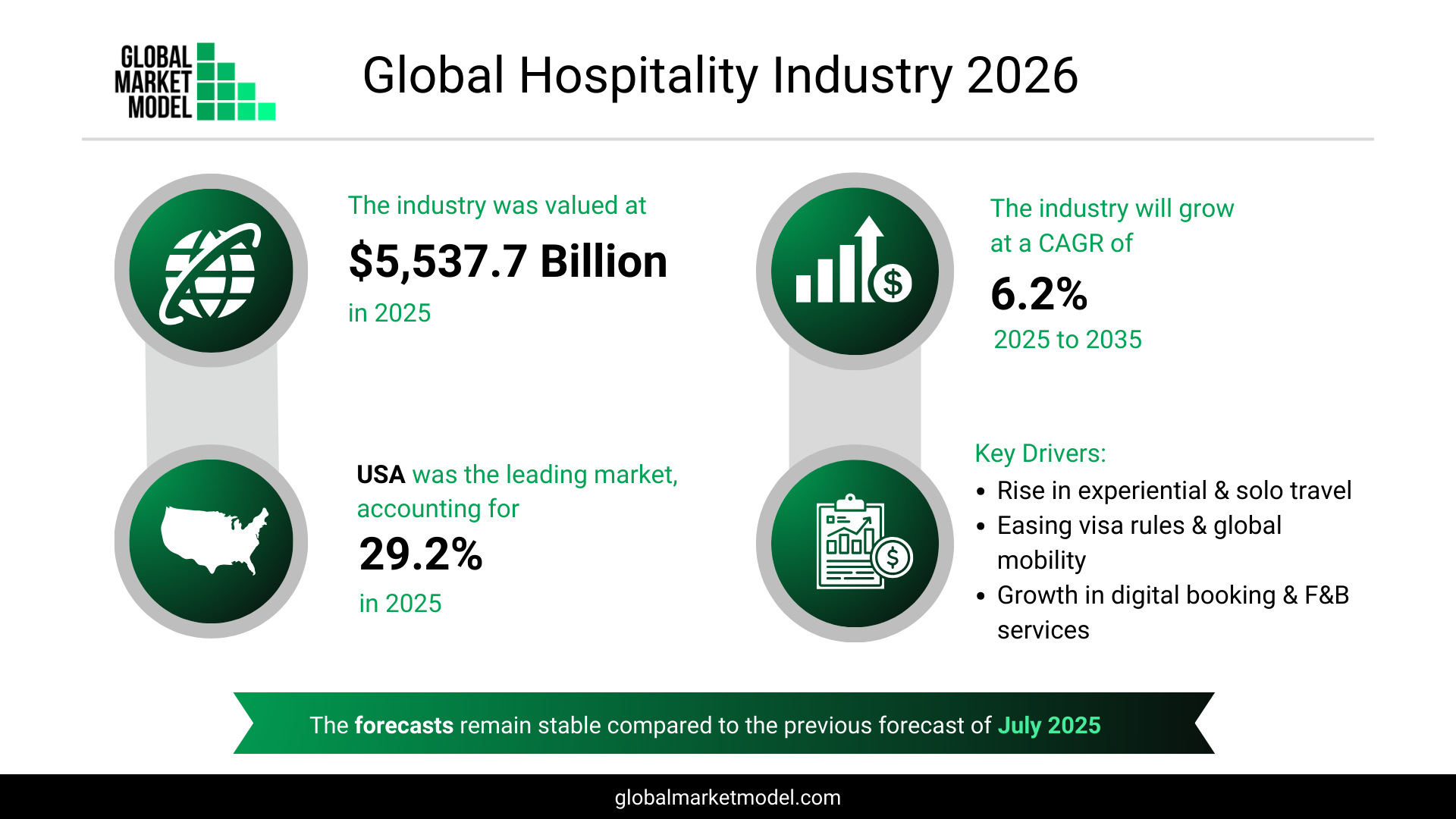

The Global Hospitality Market Reflects a Shift Toward Flexible Travel and Digitally Enabled Guest Experiences

Evolving travel behavior, service personalization, and technology adoption define the sector’s growth outlook

Market Size and Growth Expectations

Global Market Model estimates the global hospitality market at $5,537.7 billion in 2025, with the market expected to grow at a 6.2% CAGR from 2025 to 2035. Growth is being shaped by changing travel patterns, including a rise in solo and experiential travel, greater cross-border mobility for work and education, and the gradual easing of visa requirements across several regions.

At the same time, consumer expectations within hospitality are evolving, with increased emphasis on digital booking convenience, personalized travel services, and flexible food and accommodation options.

Defining the Hospitality Industry and Its Economic Role

The hospitality industry includes businesses that provide lodging, food, and beverage services, such as hotels, restaurants, bars, and related service formats catering to leisure and business travelers.

In 2025:

- The sector accounted for 4.7% of global GDP, reflecting its importance as a discretionary yet resilient service industry

- Per capita hospitality spending reached $686.6 per person per annum, supported by sustained travel and dining activity

Demand Patterns and Segment Composition

Hospitality demand continues to be reinforced by:

- Strong domestic and regional travel, particularly in emerging economies

- Growing preference for flexible and affordable accommodation, including hostels, mid-scale hotels, and alternative lodging formats

- Rising urban social activity and event-driven travel

From a market composition perspective, food and beverage services remained the largest contributor, accounting for 73.7% of total hospitality market value in 2025, underlining the sector’s reliance on dining, social, and experiential consumption.

At the country level, the United States remained the leading hospitality market, representing 29.2% of global market value in 2025, supported by a large domestic travel base, diversified accommodation offerings, and strong foodservice demand.

Cost Pressures and Operational Adjustments

Forecasts remain largely stable compared with the July 2025 outlook, despite margin pressures faced by hospitality operators over the past six months. Rising costs related to:

- Labor and wages

- Food and beverage inputs

- Utilities and operating expenses

have continued to challenge profitability across hotels and foodservice businesses.

While corporate and international travel recovery has been gradual, domestic leisure travel, event-related demand, and increased urban social engagement have helped sustain occupancy levels and foot traffic in many markets.

Technology Investment and the Path Forward

In response to both cost pressures and changing guest expectations, hospitality operators have accelerated investment in AI-powered revenue management, automated check-in and service systems, and digital customer engagement platforms. These tools are improving operational efficiency while enabling more personalized guest experiences.

Together, continued consumer interest in travel, dining, and social experiences—combined with operational digitization and service innovation—are supporting a stable near-term environment and a positive long-term growth trajectory for the global hospitality market.

Gain exclusive insights with The Global Market Model on the key metrics of the hospitality industry such as –

- Inbound international mobile students

- Number of hotel rooms

- Inbound- nights spent in hotels

- Domestic- nights spent in hotels

- Inbound - number of visitors

- Domestic - number of visitors

- Number of tourist arrivals inbound

- Number of enterprises

- Number of employees

Want to explore the future of the hospitality industry? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

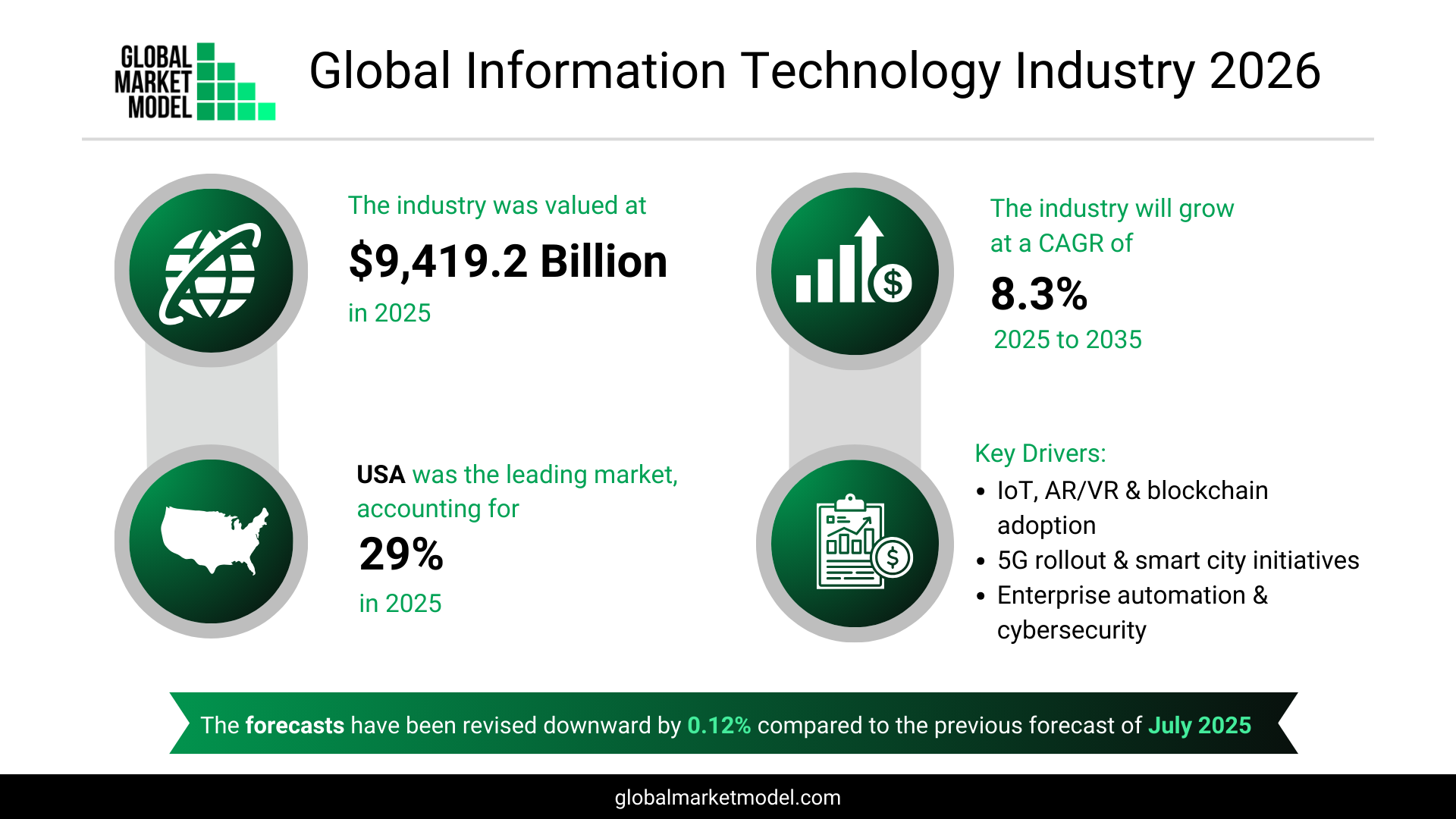

The Global Information Technology Market Expands on Cloud, AI, and Network-Led Foundations

Digital infrastructure build-out, enterprise automation, and emerging technologies anchor long-term demand

Market Size and Growth Profile

Global Market Model estimates the global information technology (IT) market at $9,419.2 billion in 2025, with the market projected to grow at a compound annual growth rate (CAGR) of 8.3% between 2025 and 2035. Growth is being driven by continued digitization across industries and sustained investment in technologies that improve connectivity, scalability, and operational efficiency.

Key contributors to market expansion include:

- Increased adoption of Internet of Things (IoT) technologies

- Broader use of AR/VR and blockchain across commercial and industrial applications

- Ongoing rollout of 5G infrastructure, enabling faster data transmission and innovation

- Expansion of e-commerce ecosystems and smart city initiatives

- Rising emphasis on cybersecurity and enterprise automation

Scope of the Information Technology Market

Information technology encompasses the use of computer systems, software, networks, and telecommunications infrastructure to manage, store, process, and transmit data. The market spans hardware, software, IT services, cloud platforms, and network technologies that support digital operations across sectors.

In 2025:

- The IT market accounted for 8.1% of global GDP, reflecting its role as a core economic enabler

- Demand was reinforced by high levels of internet connectivity, enterprise digitization, and sustained spending on cloud computing, software, and IT services

Government support for digital infrastructure, favorable policy frameworks, and widespread adoption of digital platforms across industries continue to shape demand conditions.

Segment Composition and Regional Leadership

From a market structure perspective, IT services remained the largest segment, accounting for 39.4% of total IT market value in 2025, driven by cloud migration, managed services, cybersecurity, and enterprise software integration.

Geographically, the United States led the global IT market, contributing 29% of total market value in 2025, supported by advanced digital infrastructure, strong enterprise technology adoption, and a concentration of leading technology providers.

Forecast Revisions and Near-Term Adjustments

Forecasts for the 2025–2035 period have been revised downward by 0.12% compared with the July 2025 outlook. This adjustment reflects developments observed over the past six months, including:

- More cautious enterprise IT spending, with selective delays in hardware upgrades and infrastructure expansion

- Greater focus on maximizing returns from existing digital investments

- Regulatory uncertainty linked to export restrictions and evolving data compliance requirements, particularly affecting semiconductors, computing equipment, and telecom infrastructure

At the same time, demand for AI technologies has remained strong, with increased investment directed toward generative AI, automation, and advanced analytics. Variability in monetization timelines across industries has introduced short-term uncertainty but has not weakened long-term adoption intent.

Structural Drivers Supporting Long-Term Growth

Despite near-term moderation, the long-term outlook for the information technology market remains robust. Sustained demand for cloud platforms, cybersecurity solutions, enterprise automation, and AI-driven applications continues to reinforce the sector’s strategic importance. As organizations balance efficiency with innovation, IT investment is expected to remain a central pillar of competitiveness and digital transformation across global economies.

Gain exclusive insights with The Global Market Model, on the key industry metrics of the information technology market such as –

- Number of internet users

- Number of households with computers

- Number of smartphone users

- Number of households with broadband access

- Number of enterprises

- Number of employees

Want to know more about the information technology market outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

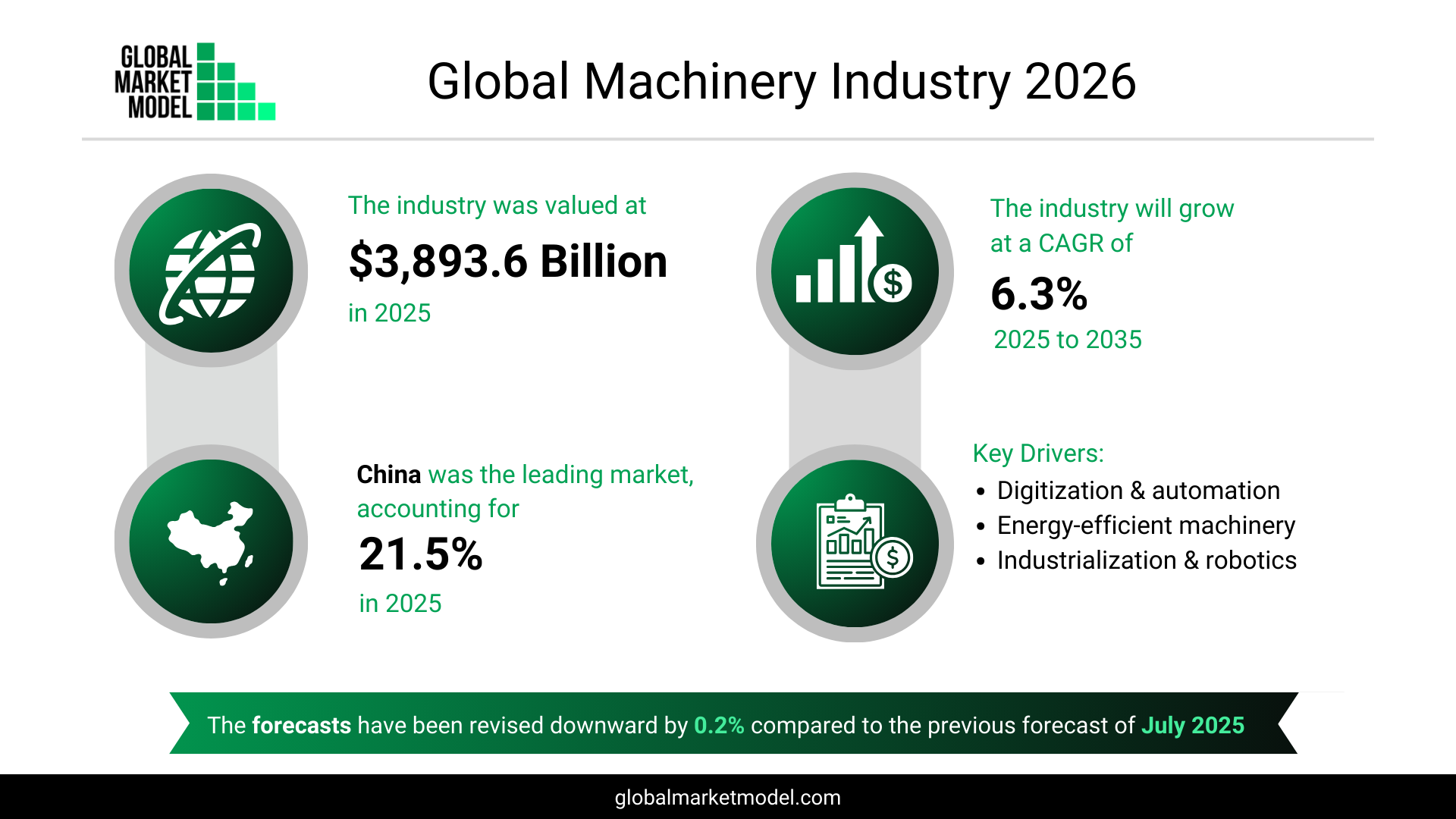

The Global Machinery Market Evolves Around Automation, Sustainability, and Smart Manufacturing

Industrial digitization, energy-efficient equipment, and selective capital investment redefine growth priorities

Market Size and Growth Trajectory

Global Market Model estimates the global machinery market at $3,893.6 billion in 2025, with the market projected to grow at a 6.3% CAGR from 2025 to 2035. Growth is being shaped less by broad-based capacity expansion and more by targeted investments in automation, digital integration, and sustainability-focused equipment.

Key factors supporting market expansion include:

- Digitization of machinery, including embedded software and data-driven controls

- Increased adoption of automation and IoT-enabled equipment

- Rising investment in smart manufacturing systems

- Growing demand for energy-efficient and sustainable machinery

- Expanding use of robotics and advanced material-handling solutions, particularly in industrial facilities

Defining the Machinery Industry and Its Economic Role

The machinery industry comprises mechanical devices and equipment designed to perform specific industrial tasks, often involving material processing, transformation, or movement across manufacturing, infrastructure, and resource extraction activities.

In 2025:

- The machinery market accounted for 3.3% of global GDP, underscoring its role as a core industrial enabler

- Demand was supported by large end-use industries across both developed and emerging economies, alongside favorable government policies and continued technological advancement

End-Use Demand and Segment Concentration

Machinery demand remains closely tied to industrial activity across multiple sectors, including manufacturing, construction, agriculture, and mining. Key structural supports include:

- Highly developed industrial economies with ongoing equipment modernization needs

- Continued industrialization in emerging markets

- Policy support for manufacturing efficiency and industrial automation

From a segmentation perspective, agriculture, construction, and mining machinery formed the largest segment of the market, accounting for 20.8% of total market value in 2025, reflecting sustained infrastructure and resource-related demand.

Geographically, the China led the global machinery market, contributing 21.5% of total market value in 2025, supported by manufacturing scale, infrastructure investment, and domestic industrial demand.

Revised Outlook and Near-Term Investment Caution

Forecasts for the 2025–2035 period have been revised downward by 0.2% compared with the July 2025 outlook. This adjustment reflects conditions observed over the past six months, including:

- Continued input cost volatility affecting equipment pricing

- More cautious capital expenditure decisions by industrial buyers

- Uneven recovery across construction and industrial activity in different regions

While easing interest rates in some major economies have improved financing conditions, many small and mid-sized enterprises have extended equipment replacement cycles, opting for incremental upgrades rather than large-scale purchases.

Areas of Resilience and Forward Direction

Despite procurement challenges linked to trade policy uncertainty, tariff-related costs, and higher prices for imported components such as engines, hydraulics, and precision parts, investment has remained resilient in specific areas. Machinery demand linked to automation, energy transition projects, renewable energy infrastructure, and productivity-enhancing equipment continues to attract capital.

Together, selective investment behavior, technology-led upgrades, and sustainability-driven equipment demand are shaping a measured near-term environment, while reinforcing a positive long-term growth outlook for the global machinery market as industrial modernization continues worldwide.

Gain exclusive insights with The Global Market Model, on key machinery industry metrics such as –

- Number of enterprises

- Number of employees

Want to know more about the machinery industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

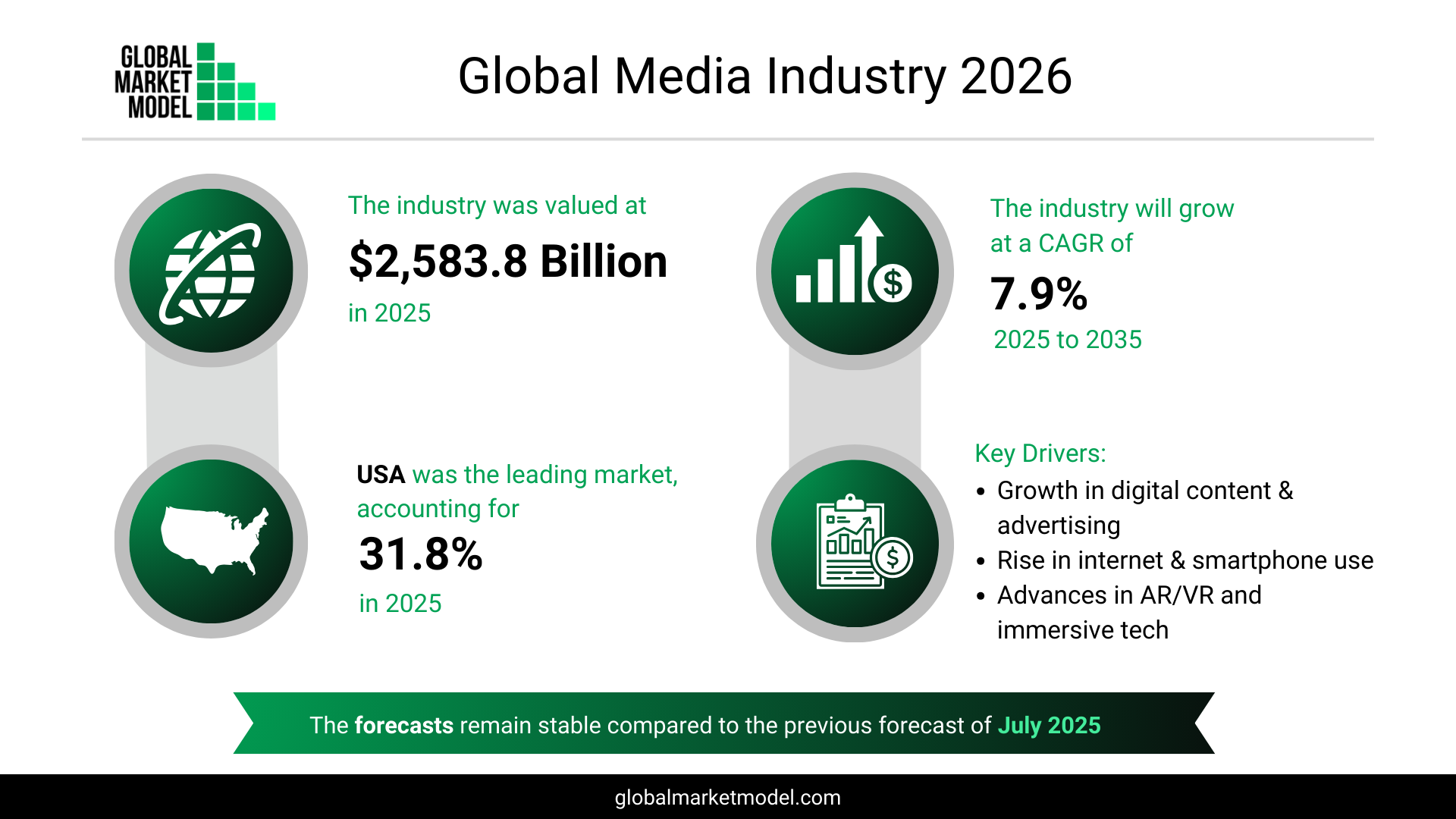

The Global Media Market Is Being Rebuilt Around Digital Platforms and Immersive Formats

Content monetization, advertising recovery, and interactive engagement redefine industry economics

Market Scale and Expansion Profile

Global Market Model estimates the global media market at $2,583.8 billion in 2025, with the market projected to expand at a 7.9% CAGR from 2025 to 2035. This growth outlook is primarily shaped by strong performance in web content, search portals, and social media, which continue to attract both consumer time and advertiser budgets.

Market expansion is being supported by:

- Increasing use of internet-connected devices across demographics

- Faster network speeds enabling richer content formats

- Advancements in augmented and virtual reality technologies

- Rising consumer spending on digital content and experiences

- Continued growth in digital advertising revenues

What the Media Industry Covers

The media industry comprises channels and platforms used to distribute information, education, entertainment, data, and promotional content, spanning digital platforms, streaming services, broadcast media, and interactive formats.

In 2025:

- The sector accounted for 2.2% of global GDP, reflecting its role as a major consumer-facing and advertising-supported industry

- Demand was reinforced by a large global audience base across both developed and developing economies

High smartphone penetration, extensive social media usage, and sustained spending on entertainment—particularly films and video content in developed markets—continue to underpin market activity.

Digital Segments Anchor Market Value

Within the overall industry, web content, search portals, and social media represented the largest segment, accounting for 29.5% of total media market value in 2025. This reflects the central role of digital platforms in content discovery, creator monetization, and performance-based advertising.

From a geographic standpoint, the United States remained the leading media market, contributing 31.8% of global market value in 2025, supported by advanced platform ecosystems, high advertising intensity, and strong consumer engagement.

Advertising Normalization and Revenue Model Shifts

Compared with the July 2025 forecast, projections remain largely stable, even as industry conditions have evolved over the past six months. A gradual normalization of global advertising budgets, particularly from retail, travel, FMCG, and consumer services, has supported revenue recovery for digital-first media platforms.

In parallel, streaming and content providers have expanded ad-supported and hybrid subscription models, improving reach and retention in an environment of heightened price sensitivity.

Engagement Innovation and Industry Direction

Media platforms have increased investment in immersive and interactive formats to strengthen engagement and diversify revenue streams. These include AR-enabled content, live commerce integrations, gaming-linked experiences, and AI-enhanced production workflows.

While economic caution has moderated discretionary spending in some regions, demand for digital content, social interaction, and performance-driven advertising remains resilient. Together, these dynamics are reshaping how value is created and captured across the global media market, supporting a stable near-term environment and a structurally positive long-term outlook.

Explore detailed metrics with The Global Market Model, including:

- Number of internet users

- Number of households with computers

- Number of smartphone users

- Number of households with broadband access

- Number of enterprises

- Number of employees

Get more in-depth insights about global media and entertainment industry overview and media industry trends with Global Market Model:

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

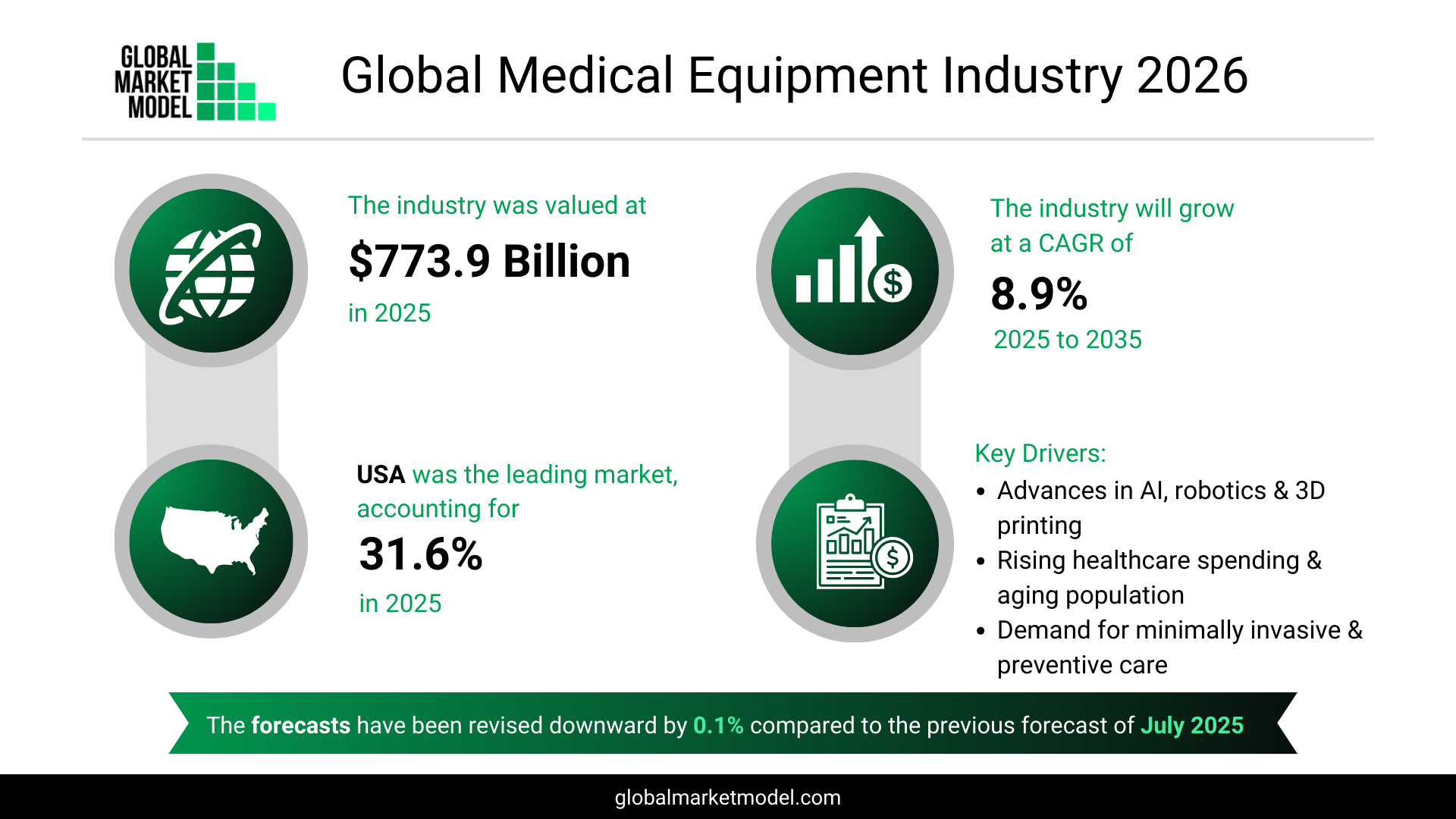

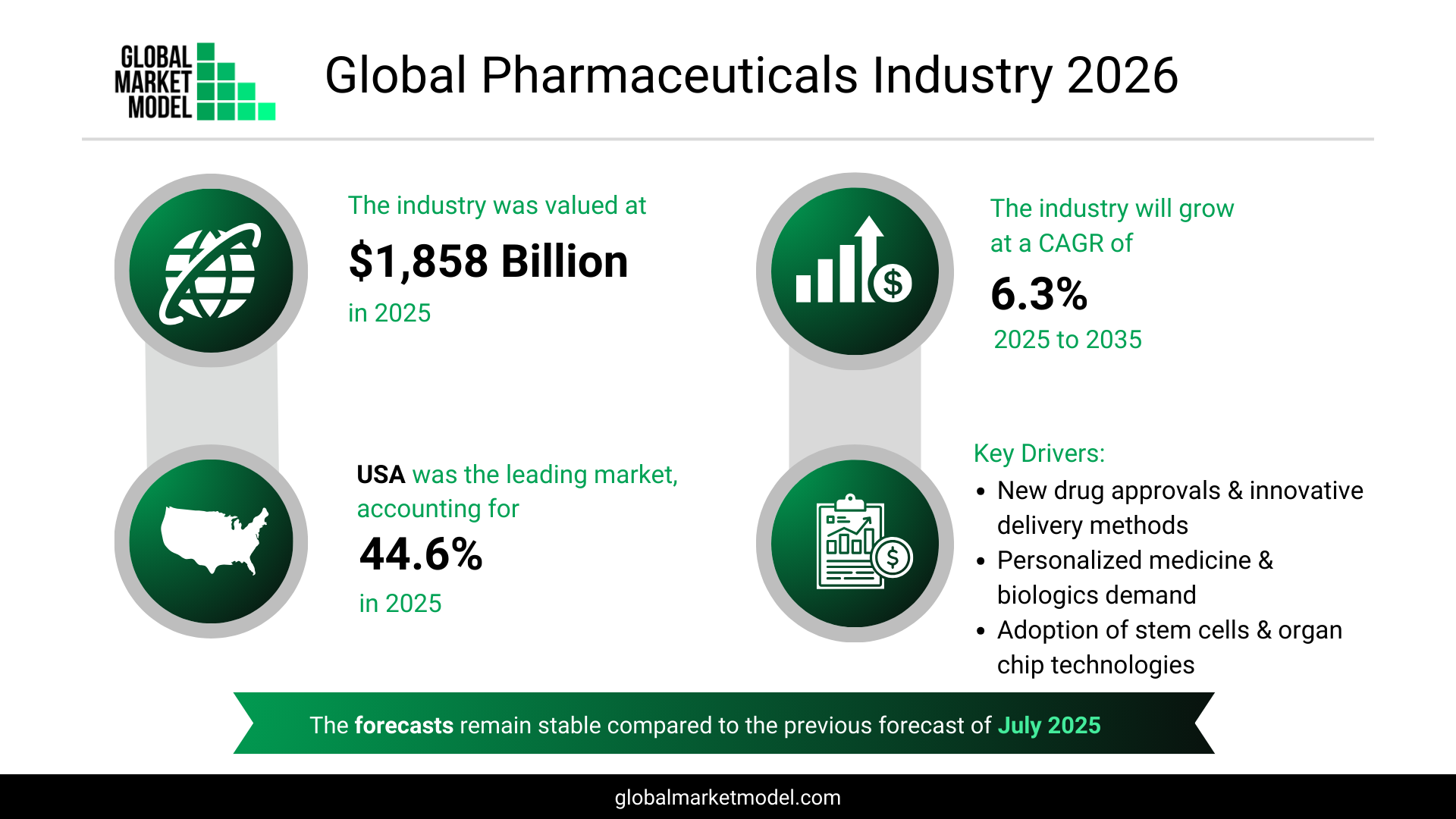

The Global Medical Equipment Market Moves Toward Diagnostics, Automation, and Preventive Care

Technology-led innovation and demographic demand reshape equipment adoption despite near-term procurement caution

Market Size and Growth Profile

Global Market Model estimates the global medical equipment market at $773.9 billion in 2025, with the market expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2025 to 2035. Growth is being driven by the accelerating integration of advanced technologies into clinical workflows and a broader shift toward early detection and preventive healthcare.

Key factors supporting market expansion include:

- Adoption of AI and machine learning in diagnostic and imaging systems

- Increased use of robotics and automation in surgical and clinical settings

- Advancements in 3D printing for customized and precision devices

- Rising demand for minimally invasive procedures

- Growing emphasis on preventive and early-stage care

Scope of the Medical Equipment Industry

Medical equipment includes devices, instruments, and machines used to prevent, diagnose, monitor, and treat diseases, as well as tools designed to restore or modify bodily functions to support patient health. These products are deployed across hospitals, diagnostic laboratories, outpatient centers, and increasingly, home-care environments.

In 2025:

- The market accounted for 0.7% of global GDP, reflecting its specialized but essential role within healthcare systems

- Demand was reinforced by high disease prevalence, aging populations, and sustained investment in clinical infrastructure

Demand Drivers and Segment Leadership

The medical equipment market continues to benefit from several long-term structural drivers:

- High incidence of chronic and age-related diseases across regions

- Strong adoption of advanced medical technologies by healthcare providers

- Expansion of hospital and diagnostic facility investments

- Growth in home-based and remote monitoring solutions

From a segmentation standpoint, in-vitro diagnostics (IVD) emerged as the largest category, accounting for 17.2% of total market value in 2025, reflecting the growing importance of testing, screening, and early diagnosis in modern care pathways.

Geographically, the United States led the global medical equipment market, contributing 31.6% of total market value in 2025, supported by high healthcare spending, rapid technology adoption, and a strong base of medical device manufacturers.

Forecast Revisions and Short-Term Constraints

Forecasts for the 2025–2035 period have been revised downward by 0.1% compared with the July 2025 outlook. This adjustment reflects developments observed over the past six months, including:

- Prioritization of labor and essential service spending by healthcare systems

- Delays in procurement of high-value capital equipment

- Inflation-driven cost pressures and longer lead times for specialized components

- Ongoing supply chain inefficiencies and existing trade tariffs affecting pricing and sourcing

These factors have temporarily slowed purchasing cycles, particularly for large-scale equipment installations.

Where Long-Term Demand Is Concentrating

Despite near-term constraints, long-term fundamentals for the medical equipment market remain strong. Demand continues to build for diagnostic technologies, digitally enabled devices, minimally invasive tools, and home-based monitoring solutions. As healthcare systems balance cost pressures with the need for efficiency, accuracy, and early intervention, these technologies are expected to play an increasingly central role in care delivery, supporting a positive long-term outlook for the global medical equipment market.

Gain exclusive insights with the Global Market Model on key medical equipment metrics, including:

- Asthma prevalence rate

- Cancer prevalence rate

- Cerebrovascular prevalence rate

- Dermatitis prevalence rate

- Diabetes prevalence rate

- Glaucoma prevalence rate

- Healthcare - number of employees

- Healthcare - number of enterprises

- Healthcare expenditure

- Hearing loss prevalence rate

- HIV prevalence rate

- Hospital beds

- Hypertension prevalence rate

Want to explore the medical equipment market outlook further? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

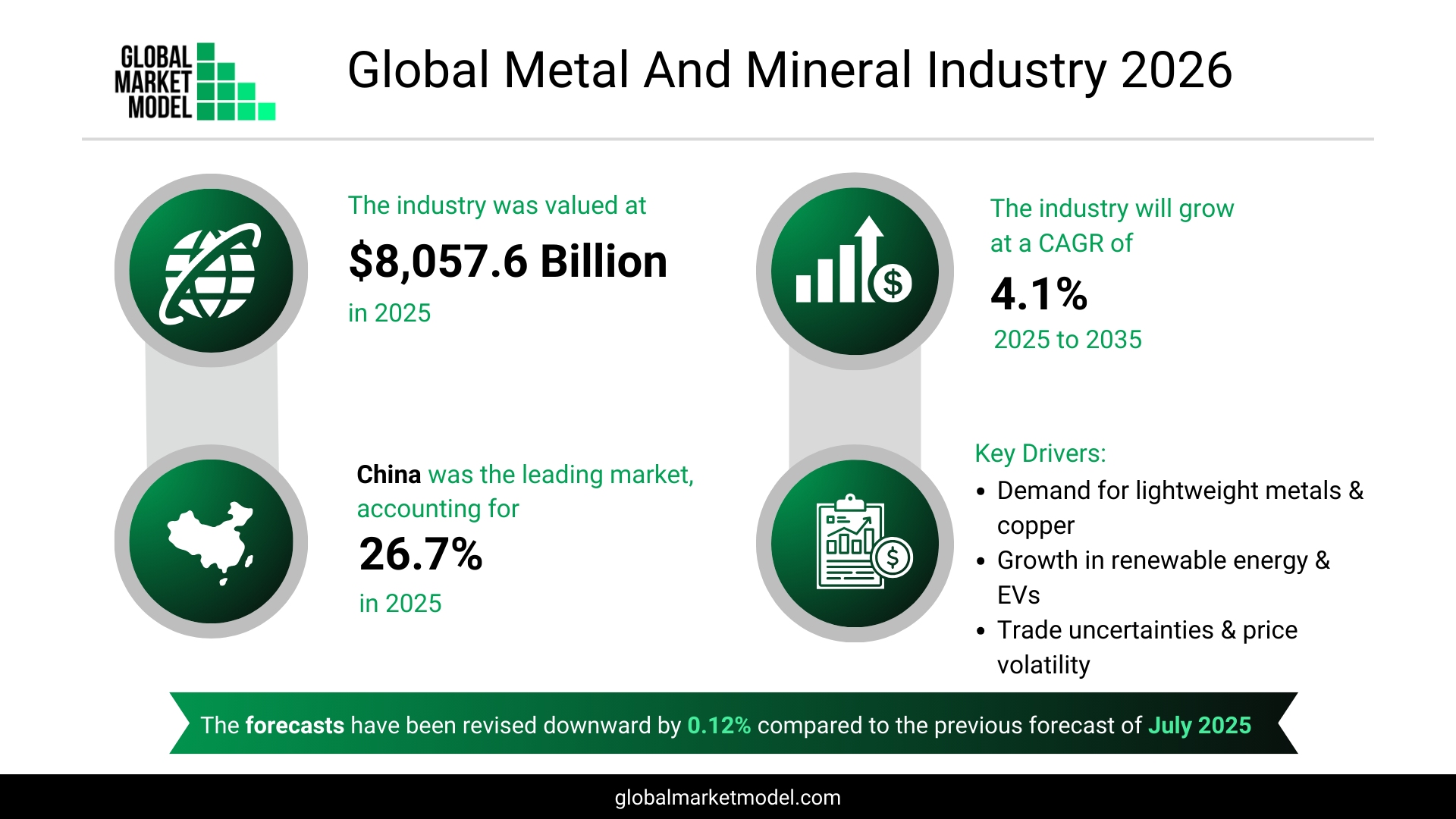

Energy Transition Metals and Material Substitution Redefine the Metals and Minerals Industry

Lightweight alternatives, electrification demand, and clean energy investment reshape consumption patterns

Market Size and Growth Context

Global Market Model estimates the metals and minerals market at $8,057.6 billion in 2025, with the market expected to grow at a 4.1% CAGR from 2025 to 2035. Growth is increasingly driven by how materials are being used, rather than by volume expansion alone, as industries adjust to sustainability, efficiency, and performance requirements.

Key growth influences include:

- Rising use of aluminum as a lighter and more cost-efficient substitute

- Expanding demand for copper across power, construction, and industrial applications

- Accelerating requirements for lithium, cobalt, nickel, and rare earth elements linked to renewable energy systems and electric vehicles

What Falls Within the Metals and Minerals Industry

Metals are ductile, malleable elements with strong electrical and thermal conductivity, while minerals are naturally occurring inorganic substances with defined chemical structures that serve as inputs for metal extraction and industrial processing.

In 2025:

- The sector accounted for 6.9% of global GDP, highlighting its foundational role across industrial economies

- Demand was supported by large populations, mature manufacturing ecosystems, and extensive downstream usage

Breadth of Industrial Demand and Market Structure

The metals and minerals industry supports a wide array of end-use sectors, including:

- Automotive and electric mobility

- Electrical equipment and power systems

- Construction and infrastructure

- Precision machinery and industrial equipment

- Aerospace and advanced manufacturing

Fabricated metal products such as bolts, fasteners, wires, springs, boilers, and valves remain essential inputs across these industries.

From a structural standpoint, the metal segment was the largest contributor, accounting for 52.4% of total market value in 2025, reflecting sustained demand for processed and semi-finished metals.

Regionally, China led the metals and minerals market, representing 26.7% of global demand, supported by manufacturing scale, infrastructure activity, and domestic consumption.

Short-Term Constraints and Forecast Adjustments

Growth forecasts for 2025–2035 have been revised downward by 0.12% compared with the July 2025 outlook. Over the past six months, demand has been influenced by:

- Uneven global manufacturing output

- Slower construction activity in select regions

- Trade-related uncertainty, including U.S. tariffs on steel, aluminum, and rare earths

- Resulting price volatility and cautious procurement behavior

Commodity price fluctuations and delays in capital-intensive projects have further moderated short-term consumption.

Where Long-Term Demand Is Concentrating

Despite near-term moderation, long-term demand drivers remain intact. Energy transition programs, investment in renewable power infrastructure, and strategic sourcing of critical minerals for batteries, grids, and electrification technologies continue to anchor future consumption. As industries prioritize material efficiency, sustainability, and supply security, these forces are expected to sustain measured but durable growth across the metals and minerals industry over the forecast period.

Explore in-depth market indicators with The Global Market Model, including:

- Number of enterprises

- Number of employees

Want to know more about the global metal and mineral industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

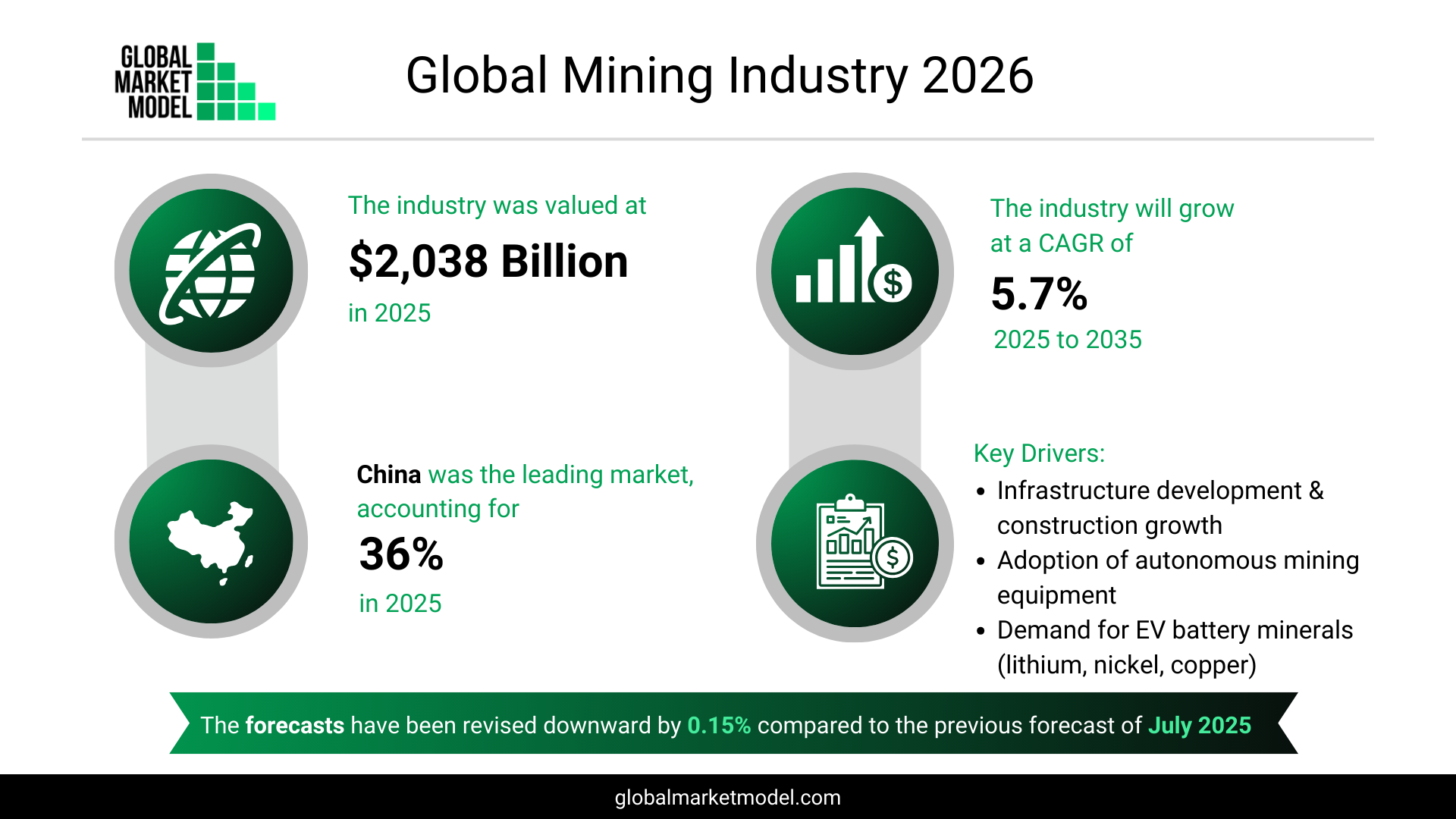

Mining Industry Demand Rebalances Between Infrastructure Needs and Critical Minerals Supply

Construction activity, automation, and EV-linked mineral requirements shape a moderated but durable outlook

Market Scale and Growth Direction

Global Market Model values the global mining market at $2,038 billion in 2025 and projects growth at a 5.7% CAGR between 2025 and 2035. Market expansion is being shaped by a combination of traditional demand from infrastructure and construction, alongside structurally rising requirements for minerals essential to electrification and energy transition technologies.

Key contributors influencing demand include:

- Increased infrastructure development and construction activity

- Wider adoption of autonomous and digitally enabled mining equipment

- Rising demand for electric vehicle (EV) battery minerals, including:

- Lithium

- Nickel

- Graphite

- Copper

What the Mining Market Encompasses

Mining involves the extraction of minerals, metals, and other valuable materials from the earth, supplying essential raw inputs for manufacturing, energy generation, construction, and consumer goods production.

In 2025:

- The mining market accounted for 1.7% of global GDP, reflecting its role as a foundational upstream industry

- Market activity was supported by widespread mining operations globally, high capital investment, and strong downstream demand from large industrial and urban economies

End-Use Dependence and Segment Concentration

Demand for mined materials remains closely tied to large-scale industrial and urban consumption patterns, particularly in regions with expanding infrastructure and manufacturing bases.

From a market structure perspective:

- The coal, lignite, and anthracite segment remained the largest, accounting for 47.2% of total mining market value in 2025, highlighting the continued role of conventional energy and industrial fuels

- Mining output continues to feed end-use sectors across construction, power generation, manufacturing, and transportation

Geographically, China led the global mining market, contributing 36.0% of total market value in 2025, supported by scale, domestic demand, and extensive infrastructure and industrial activity.

Forecast Revisions and Near-Term Constraints

Growth forecasts for the 2025–2035 period have been revised downward by 0.15% compared with the July 2025 outlook. Over the past six months, market performance has been influenced by:

- Persistent commodity price volatility

- Delays in large-scale mining and infrastructure projects

- More cautious procurement and capital investment decisions

Trade-related uncertainty and fluctuating pricing have added complexity, particularly for projects tied to long development timelines and high upfront capital requirements.

Strategic Minerals and the Longer-Term View

Despite near-term moderation, demand for energy transition minerals—including lithium, cobalt, and copper—continues to be supported by EV adoption and renewable energy expansion. At the same time, ongoing discussions around mineral sourcing agreements, local processing incentives, and critical mineral security strategies in major economies are reshaping investment priorities and supply chain planning.

Together, sustained infrastructure needs, long-term electrification policies, and strategic focus on securing critical raw materials are expected to underpin continued relevance and measured growth for the global mining market over the forecast period, even as short-term conditions remain uneven.

Gain insights on key industry metrics in the mining sector with the Global Market Model, including:

- Number of enterprises

- Number of employees

Want to explore more mining industry trends and forecasts?

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

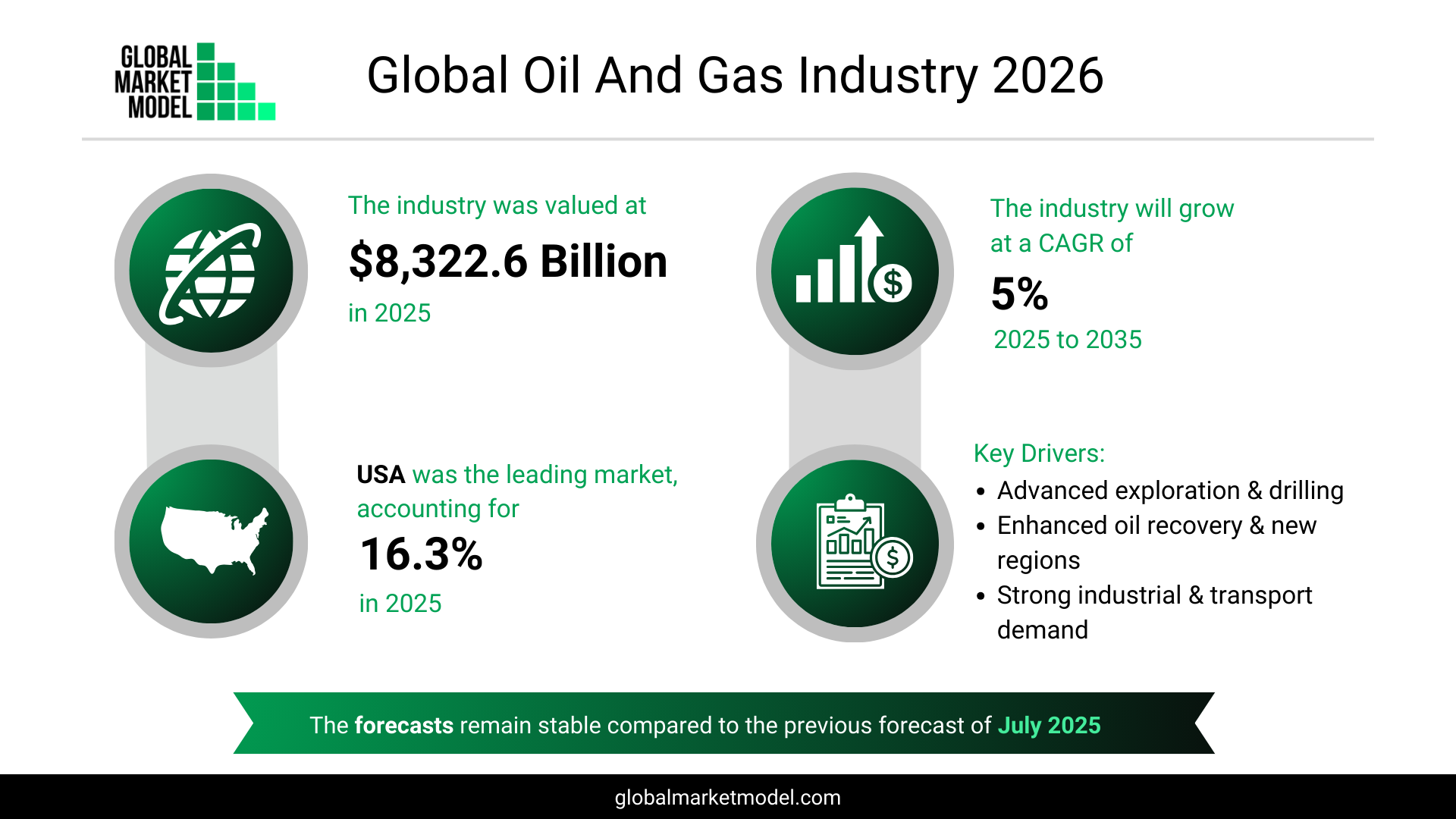

Oil and Gas Markets Navigate Technology-Led Supply Expansion Amid Energy Transition Pressures

Enhanced recovery methods, frontier exploration, and geopolitical dynamics shape a measured growth outlook

Market Size and Growth Context

Global Market Model estimates the global oil and gas market at $8,322.6 billion in 2025, with the market expected to grow at a 5.0% CAGR from 2025 to 2035. Growth over the forecast period is being supported by continued technological innovation across exploration, drilling, and refining, alongside efforts to maximize output from existing reserves.

Key factors influencing market performance include:

- Rapid innovation in exploration and drilling technologies

- Deployment of enhanced oil recovery (EOR) techniques to extend the life of mature fields

- Increased exploration activity in untapped and frontier regions

- Ongoing demand from energy-intensive end-use sectors

At the same time, the growing cost competitiveness and adoption of renewable energy sources is expected to exert gradual structural pressure on long-term oil and gas demand.

Scope of the Oil and Gas Industry and Economic Role

Oil and gas extraction involves the exploration, development, and production of petroleum and natural gas from onshore and offshore wells, supplying fuel and feedstock to transportation, industrial, residential, and commercial markets.

In 2025:

- The oil and gas market accounted for 7.1% of global GDP, underlining its continued macroeconomic significance

- Demand remained broad-based across mobility, manufacturing, power generation, and heating applications

Segment Structure and Geographic Leadership

Within the industry, upstream oil and gas activities—including exploration and production—represented the largest segment, accounting for 58% of total market value in 2025. This reflects sustained investment focus on securing and maintaining supply in a volatile geopolitical and energy-transition environment.

At the country level, the United States was the leading oil and gas market, contributing 16.3% of global market value in 2025, supported by shale production, advanced extraction technologies, and large domestic consumption.

Near-Term Volatility and Policy Influences

Forecasts remain stable compared with the July 2025 outlook, despite several short-term disruptions over the past six months. Market conditions have been influenced by:

- Shipping disruptions in the Red Sea, affecting energy transport routes

- Infrastructure challenges in Eastern Europe, contributing to regional supply uncertainty

- Inventory management by major consuming nations, helping moderate price volatility

- Continued production discipline by OPEC+, supporting baseline price stability

In parallel, newly implemented U.S. tariffs on select oil and gas equipment have added to global supply chain costs, influencing investment timing and delaying certain capital projects.

The Sector’s Transitional Position Going Forward

Despite near-term frictions and longer-term decarbonization pressures, oil and gas continues to play a transitional role in global energy systems. Industrial demand, transportation needs, and energy security considerations remain central to consumption patterns, while technological advances help improve efficiency and recovery rates. Together, these factors are expected to support steady, technology-driven growth for the oil and gas market over the forecast period, even as the global energy mix gradually evolves.

Gain exclusive insights with The Global Market Model on key industry metrics for the oil and gas sector such as –

- Oil reserves

- Gas reserves

- Active rigs

- Oil refinery throughput

- Oil refinery capacity

- Number of enterprises

- Number of employees

Want to know more about the oil and gas industry outlook? Let us help you!

Request a Demo

The Global Market Model is the world’s largest database of market forecasts. Forecasts for over 16,000 markets are updated semi-annually on the basis of economic, geo-political and sector-specific factors. The current forecast was made in January 2026, revising the previous forecasts made in July 2025.

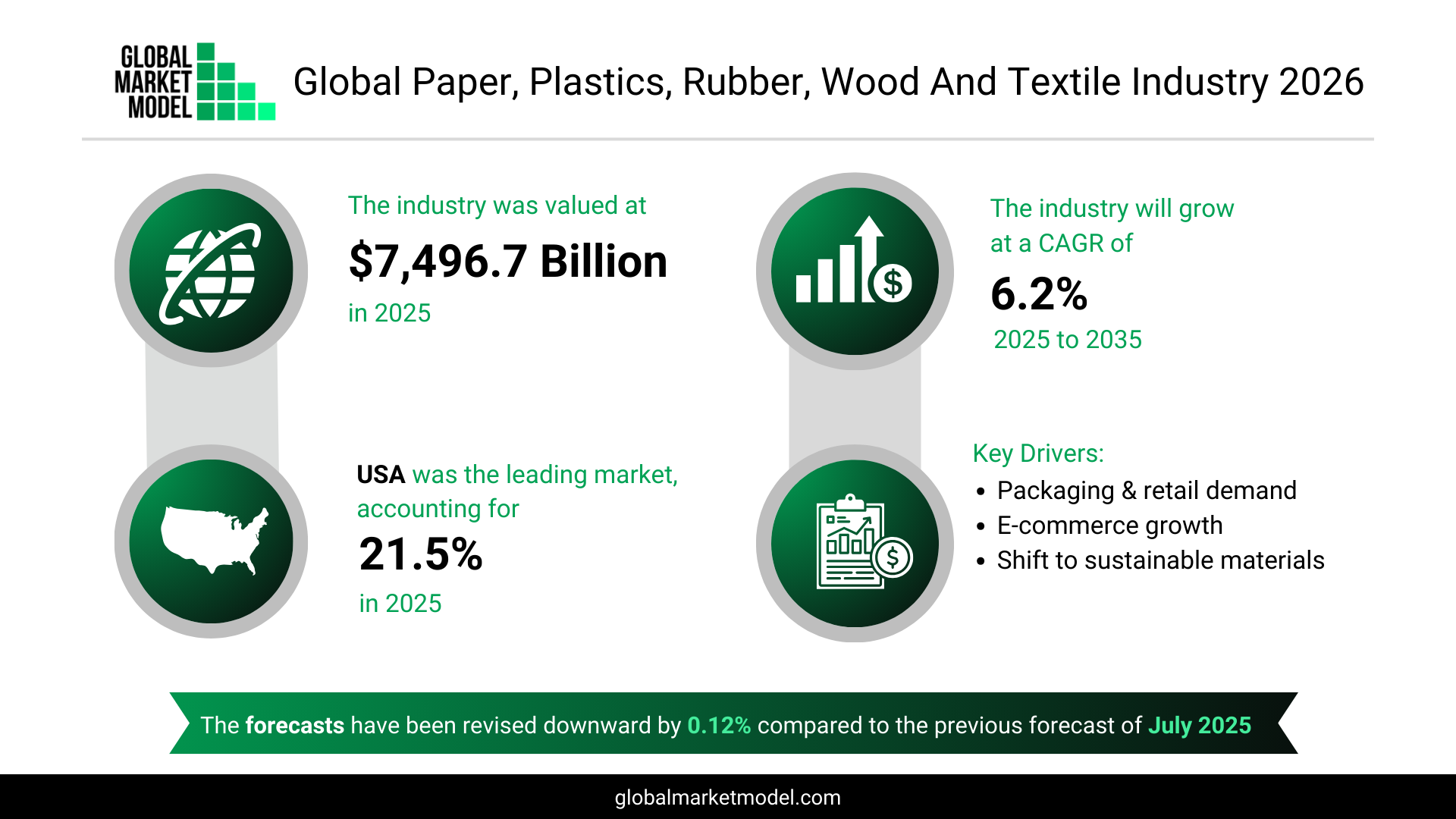

Packaging Demand and Sustainability Rules Reshape the Paper, Plastics, Rubber, Wood, and Textile Industry

E-commerce scale, material substitution, and regulatory pressure influence how the market evolves

Market Size and Growth Trajectory

Global Market Model estimates the paper, plastics, rubber, wood, and textile market at $7,496.7 billion in 2025, with the market expected to grow at a 6.2% CAGR from 2025 to 2035. Growth is closely linked to sustained demand from packaging, retail, furniture, fashion, and construction, with e-commerce acting as a major volume driver for several material categories.

Packaging demand, in particular, continues to support consumption of paperboard and flexible plastics, while sustainability regulations are accelerating shifts toward biodegradable, recyclable, and recycled-content materials.

What the Industry Covers and Its Economic Weight

This market spans a diverse group of material categories:

- Paper produced from fibrous pulp

- Plastics derived from synthetic organic polymers

- Rubber materials with elastic and shape-recovery properties

- Wood as a structural and functional natural material

- Textiles manufactured through weaving or knitting yarns

In 2025:

- The market accounted for 6.4% of global GDP, underscoring its importance across consumer and industrial value chains

- Demand was reinforced by rapid urbanization, high consumer spending, and broad usage across developed and developing economies

Demand Base and Segment Leadership

The market benefits from a wide and resilient demand base, supported by:

- Large consumer populations across income levels

- Strong downstream demand from consumer goods, construction, and industrial manufacturing

- Continued growth in retail and online commerce, increasing packaging intensity

From a segment perspective, plastics and rubber products formed the largest category, accounting for 20.7% of total market value in 2025, reflecting their extensive use in packaging, automotive components, consumer goods, and industrial applications.

At the country level, the United States led the global market, contributing 21.5% of total value in 2025, supported by strong consumer demand, mature retail infrastructure, and large-scale manufacturing activity.

Short-Term Constraints and Forecast Adjustments

Forecasts for the 2025–2035 period have been revised downward by 0.12% compared with the July 2025 outlook. Over the past six months, market activity has been influenced by:

- Constrained availability of raw materials

- More cautious capital expenditure by manufacturers

- Ongoing global trade uncertainty, including U.S. tariffs on selected plastics and rubber products

These factors have moderated procurement and production activity in the near term.

Sustainability Investment and the Forward Path

At the same time, stabilizing energy prices and improved logistics performance have helped ease some cost pressures. Importantly, continued investment in sustainable packaging, recycled materials, and environmentally compliant product design is providing long-term structural support. As regulatory standards tighten and e-commerce volumes remain elevated, these shifts are expected to play a central role in shaping demand patterns and maintaining a broadly positive long-term outlook for the paper, plastics, rubber, wood, and textile industry.

Gain exclusive insights with The Global Market Model, on the key industry metrics of the paper, plastic, rubber, wood industry market such as –

- Number of enterprises

- Number of employees

Want to know more about this Paper, Plastic, Rubber, Wood Industry?

Request a Demo